What Business Bank Account Works Best With Wagepoint in Canada

Discover the best business bank account for Wagepoint in Canada. Compare features, speed, and cost to streamline payroll and maximize efficiency for your business.

.png)

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

Running payroll through Wagepoint requires more than just picking any business bank account. The right banking foundation can mean the difference between instant verification and waiting days to process your first payroll run. Your choice of bank account directly impacts how quickly you can pay employees, manage multi-currency payroll, and automate your financial operations.

This guide examines which Canadian business bank accounts work best with Wagepoint, comparing verification methods, essential features, and real-world performance across traditional banks and modern financial platforms.

What You Need to Know About Banking Requirements for Wagepoint

Wagepoint requires verified bank account access to process direct deposit payroll for your employees. This verification ensures the platform can withdraw funds from your account to pay your team on schedule, this is usually called a Pre-Authorized Debit or PAD.

The platform offers two verification methods: micro-deposit verification that takes 2-3 business days, and Plaid instant verification that completes immediately. You'll need your transit number, institution number, and account number to connect any account. While a void cheque provides this information, you can also find these details in your online banking portal.

Most Canadian banks support Wagepoint verification, but the speed and ease vary significantly between providers. Real Canadian account infrastructure matters because it enables Electronic Funds Transfer (EFT) and pre-authorized debit functionality. Without these capabilities, you may face delays or be forced to use expensive wire transfers for payroll processing.

How Wagepoint Bank Verification Works

Wagepoint uses two distinct methods to verify your business bank account ownership and ensure secure payroll processing. Understanding these options helps you choose the fastest path to running your first payroll.

Micro-Deposit Verification

Micro-deposit verification involves Wagepoint sending two small deposits (typically under $1) to your bank account. You'll need to wait 2-3 business days for these deposits to appear, then log back into Wagepoint to confirm the exact amounts.

This method works with all Canadian banks but requires patience.

Plaid Instant Verification

Plaid instant verification connects directly to your online banking through secure authentication. You simply log into your bank account through Wagepoint's interface, and verification completes immediately.

Major banks and modern financial platforms that support Plaid include TD, RBC, Scotiabank, and Venn. This method eliminates waiting periods and lets you run payroll the same day you set up Wagepoint.

Essential Banking Features for Wagepoint Payroll

Not all business accounts offer the capabilities required for smooth Wagepoint payroll operations. Understanding these essential features helps you avoid accounts that create unnecessary friction or force expensive workarounds.

Your business bank account needs specific capabilities to work effectively with Wagepoint:

• EFT (Electronic Funds Transfer) capability for direct deposit

• Pre-authorized debit support for Wagepoint to withdraw payroll funds

• Real Canadian account infrastructure (not virtual or US-based accounts)

• Online banking access for Plaid verification

• No transaction limits that could block payroll runs

• Low or no monthly fees to reduce operational costs

• Integration with accounting software (QuickBooks, Xero)

EFT capability and real Canadian account infrastructure are non-negotiable for payroll processing. Without EFT support, you cannot send direct deposits to employee accounts. Accounts lacking pre-authorized debit force manual transfers before each payroll run, creating administrative overhead and risk of missed payments.

Some financial platforms marketed to Canadian businesses actually provide US-based or virtual accounts that lack these essential features. These limitations force businesses to use wire transfers at $30-50 per payroll run instead of standard EFT transfers that cost pennies.

Comparing Business Bank Accounts for Wagepoint Integration

While Wagepoint works with most Canadian banks, account features vary significantly in ways that impact payroll efficiency, cost, and operational simplicity.

Traditional Big 5 Banks (RBC, TD, Scotiabank, BMO, CIBC)

Traditional banks provide established infrastructure with full EFT support and branch access for complex banking needs. They typically require micro-deposit verification, adding 2-3 days to your Wagepoint setup. Monthly fees range from $15-120 depending on your plan and transaction volume.

Key limitations include high foreign exchange markups (2.5-3%), no multi-currency support without separate accounts, and manual reconciliation requirements. These banks suit established businesses comfortable with traditional banking and willing to pay premium fees for in-person service.

Credit Unions

Credit unions offer competitive pricing and strong local relationships. They support EFT and direct deposit requirements for Wagepoint, typically using micro-deposit verification. Monthly fees often run lower than big banks at $0-25.

Their limitations center on technology infrastructure. Many credit unions lack advanced digital features, offer limited multi-currency options, and may not integrate with modern accounting platforms. They work well for community-focused businesses with straightforward domestic payroll needs.

Wise Business

Wise excels at multi-currency capabilities with support for 40+ currencies and low FX fees of 0.4-0.6%. Some regions support Plaid verification, though availability varies. The platform integrates with major accounting software.

Critical limitations make Wise problematic for Canadian payroll. The platform cannot send Canadian EFT payments, only receive them. It lacks Interac e-Transfer® support entirely. These restrictions mean Wise cannot function as a primary payroll account for Canadian businesses paying local employees.

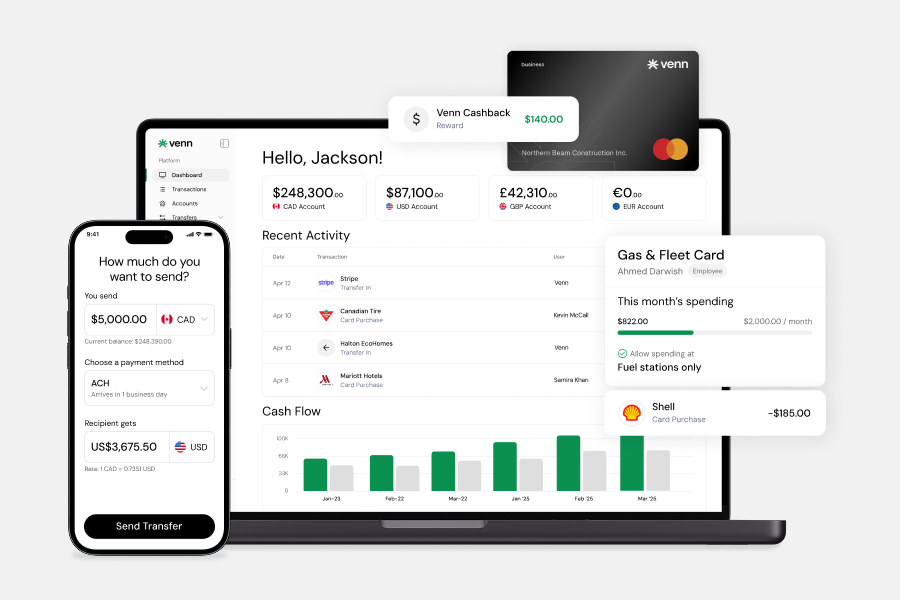

Venn

Venn provides real Canadian account infrastructure built on Peoples Trust Bank rails, ensuring full EFT and pre-authorized debit support. The platform includes multi-currency accounts (CAD, USD, GBP, EUR) without additional fees.

Automated two-way sync with QuickBooks and Xero eliminates manual payroll entry reconciliation. With 0.25% FX rates, free unlimited Interac e-Transfer®, and built-in accounts payable and expense management, Venn serves modern SMBs that want payroll, AP, and accounting automation in one platform. The Essentials plan starts at $0 monthly, making it accessible for growing businesses.

Why Venn Is the Best Business Account for Wagepoint Users

Venn's real Canadian account infrastructure, built on Peoples Trust Bank rails, enables full EFT and pre-authorized debit functionality essential for payroll.

Beyond basic banking requirements, Venn includes multi-currency accounts (CAD, USD, GBP, EUR) that eliminate the need for separate accounts at different institutions. Automated two-way sync with QuickBooks and Xero means payroll entries flow automatically into your accounting system. Built-in accounts payable lets you manage vendor payments alongside payroll in one platform. Free unlimited Interac e-Transfer® enables quick contractor or bonus payments without per-transaction fees.

The platform's 0.25% FX rates save thousands compared to traditional banks charging 2.5-3%. With $0 monthly fees on the Essentials plan and 1% unlimited cashback on corporate card spend, Venn eliminates the need for multiple tools by combining banking, AP software, and expense management in one platform.

Sign up for Venn to streamline your Wagepoint payroll operations.

How to Choose the Right Bank Account for Your Payroll Needs

Selecting the right bank account for Wagepoint depends on your business complexity, international operations, and automation requirements.

Consider these factors when evaluating options:

• Verification speed (instant vs. 2-3 days)

• EFT and pre-authorized debit support

• Multi-currency needs if you pay international contractors

• Accounting software integration requirements

• Monthly fees vs. transaction costs

• FX rates if you operate across borders

• Whether you need AP and expense tools in addition to payroll

Businesses with straightforward domestic payroll may find traditional banks sufficient despite higher costs and manual processes. The branch access and established relationships provide value for some operations.

Growing companies with international operations, multiple currencies, or automation needs benefit from purpose-built platforms like Venn. The combination of instant verification, multi-currency support, and automated accounting sync eliminates friction that slows payroll operations and creates administrative overhead.

Common Wagepoint Banking Issues and How to Avoid Them

Understanding common banking-related issues helps you avoid payroll delays and operational disruptions.

Verification Delays

Micro-deposit verification typically causes the longest delays in Wagepoint setup. Banks that don't support Plaid force this 2-3 day waiting period. Incorrect account information can extend delays further when verification fails. Choose accounts with Plaid support for instant verification. Double-check all account numbers against your void cheque or online banking before submitting.

Failed Payroll Withdrawals

Insufficient funds represent the most common cause of failed payroll runs. Pre-authorized debit settings not properly configured create another failure point. Maintain a buffer in your payroll account equal to at least one full payroll cycle. Verify PAD authorization is active and properly configured for Wagepoint's withdrawal amounts.

Manual Reconciliation Overhead

Banks without accounting integration force manual entry of every payroll transaction into QuickBooks or Xero. This creates hours of administrative work and increases error risk. Choose accounts with automated two-way sync like Venn to eliminate manual data entry and ensure accurate financial records.

Conclusion

While Wagepoint works with most Canadian banks, your account choice significantly impacts payroll efficiency, cost, and administrative burden. Traditional banks provide basic functionality but often require manual processes, charge high fees, and lack modern integrations that save time.

Venn eliminates common friction points through real Canadian infrastructure, instant verification, multi-currency support, and automated accounting sync. The platform's comprehensive approach to business banking means you can manage payroll, accounts payable, and expense management in one system while saving on fees and foreign exchange.

Sign up for Venn to transform your Wagepoint payroll operations.

Frequently Asked Questions

Can I use any Canadian bank account with Wagepoint?

A: Most Canadian bank accounts work with Wagepoint, but they must specifically support EFT payments and pre-authorized debits. Virtual or US-based accounts often lack these specific Canadian banking capabilities, which are essential for running compliant payroll.

What information do I need to connect my bank to Wagepoint?

A: To successfully connect your account, you need three pieces of information: your transit number (5 digits), your institution number (3 digits), and your account number. This information is typically found on a void cheque or clearly displayed within your online banking portal.

How long does bank verification take in Wagepoint?

A: The duration of the verification depends on the method used. Using Plaid instant verification completes the process immediately. However, if you opt for micro-deposit verification, it typically takes 2-3 business days depending on your bank's processing speed for the small test deposits.

Does Wagepoint support USD payroll accounts?

A: Yes, Wagepoint supports USD accounts, primarily for paying international contractors or US-based employees. To ensure smooth transactions, your bank must offer true USD accounts with ACH capabilities (like Venn), not just simple currency conversion accounts.

Do I need a separate account for payroll?

A: While not strictly legally required, many businesses use a dedicated payroll account. This practice provides two main benefits: better cash flow management (ensuring payroll funds are separate) and significantly cleaner accounting records for easier reconciliation and faster auditing.

Based on internal analysis of total markups and FX fees charged by major Canadian financial institutions in April 2025.

Interac® and e-Transfer® are registered trademarks of Interac Corp.

---

**Disclaimer:** This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Venn Software Inc or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.