What Business Bank Account Works Best With Rippling in Canada

Discover which business bank account works best with Rippling in Canada. Compare integration, settlement speeds, and features to streamline your payroll.

.png)

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

Running payroll through Rippling promises 90-second processing and automated tax calculations, but many Canadian businesses discover their banking infrastructure creates unexpected bottlenecks. Failed integrations, multi-day settlement delays, and missing features like pre-authorized debits can turn efficient HR software into a source of payroll headaches.

This guide examines which business bank accounts actually deliver on Rippling's promise of streamlined payroll operations. We compared traditional banks and modern fintech platforms across the factors that matter most: integration reliability, settlement speeds, EFT support, and multi-currency capabilities.

You'll learn exactly how each account connects to Rippling, what to expect for payroll funding timelines, and which providers offer the infrastructure needed for seamless benefits administration and cross-border team payments.

Why Rippling Integration Matters for Canadian Payroll

Seamless banking integration determines whether Rippling becomes a productivity multiplier or just another software subscription that underdelivers. The right connection enables automated workflows that save hours each pay period.

Rippling requires reliable EFT rails to process Canadian payroll direct deposits on schedule. Without proper banking infrastructure, your employees face delayed payments even when you submit payroll on time.

Integration methods vary significantly between providers. Direct API connections offer the fastest, most reliable performance. Plaid-based integrations add an intermediary layer that can fail or require manual re-authentication. Manual entry creates the most friction and error potential.

Settlement timing directly impacts employee satisfaction. Same-day processing means staff receive funds when expected. Traditional banks often add 1-2 business days to every transaction, creating cash flow challenges for your team.

Pre-authorized debit capability proves essential for benefits administration. Without this feature, you cannot automate health insurance premiums, retirement contributions, or other deductions through Rippling's benefits module.

Multi-currency support becomes critical for businesses with US or international team members. Running payroll in multiple currencies through separate accounts adds complexity, conversion fees, and reconciliation headaches that proper multi-currency accounts eliminate.

What to Look for in a Business Account for Rippling

Not all business accounts work equally well with Rippling. Understanding these key features helps you avoid integration failures and payroll delays.

• Direct EFT and ACH support for payroll processing

• Fast settlement times (same-day or next-day funding)

• Pre-authorized debit capabilities for benefits administration

• Multi-currency accounts if managing cross-border teams

• Low or no monthly fees that don't erode payroll budgets

• Real-time transaction visibility for reconciliation

Best Business Bank Accounts for Rippling in Canada (2025)

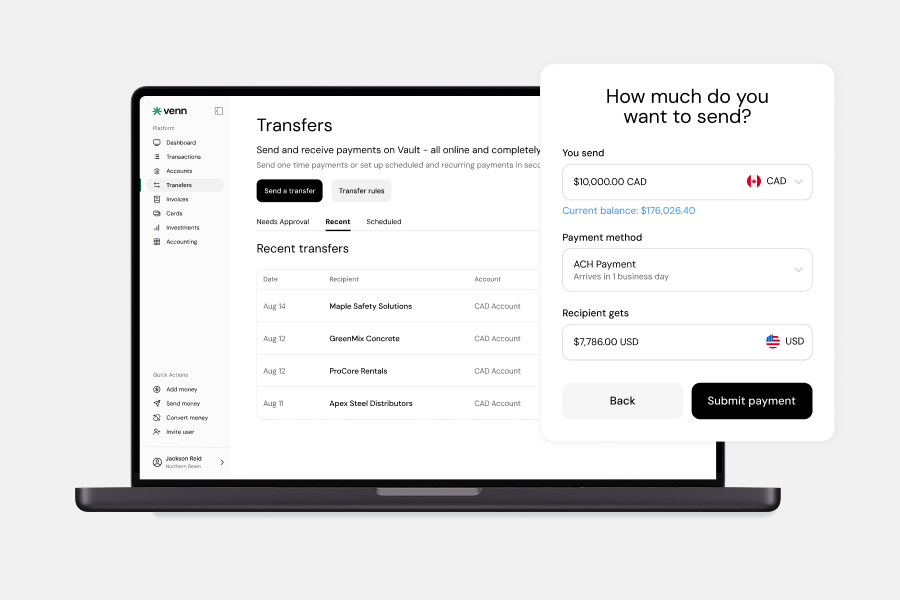

1. Venn Multi-Currency Business Account

Best Overall for Rippling Integration and Modern Payroll Operations

Venn provides real Canadian banking rails through Peoples Trust infrastructure, enabling direct EFT for payroll without the delays common to fintech overlays. The platform connects to Rippling via Plaid with consistent same-day or next-day settlement, eliminating the funding gaps that plague payroll operations.

The unique advantage comes from Venn's real local US account with true ACH capability. Unlike traditional Canadian banks that offer SWIFT-based "US accounts" requiring $17 inbound wire fees, Venn enables genuine US-to-US transfers. This infrastructure proves essential for businesses running cross-border payroll through Rippling.

Key Features for Rippling Users:

• Direct EFT and ACH support for payroll

• Pre-authorized debit capability for benefits administration

• CAD, USD, GBP, EUR accounts included

• Free unlimited Interac e-Transfers®

• Real-time transaction visibility and accounting sync

• No monthly fees on Essentials plan

• 1% unlimited cashback on corporate card spend

Why It Works Well With Rippling:

Venn's infrastructure supports the full range of Rippling payroll functions, from direct deposits to benefits deductions, without the delays or limitations of traditional banks. The pre-authorized debit capability enables automated benefits administration, while multi-currency accounts eliminate conversion fees for international team payments.

2. RBC Digital Choice Business Account

Traditional Banking Option With Rippling Compatibility

RBC connects to Rippling through Plaid integration, providing a familiar option for businesses comfortable with established banking relationships. The Digital Choice account offers unlimited electronic transactions, making it suitable for regular payroll processing without per-transaction fees.

Settlement times typically run 1-2 business days, adding delay between payroll submission and employee receipt. The account lacks multi-currency support, forcing businesses with international teams to manage separate US dollar accounts with additional fees.

Key Features:

• Plaid integration for Rippling connectivity

• Unlimited electronic transactions

• 10 free Interac e-Transfers® monthly

• $6 monthly fee

• 2.5-3% FX markup on international transactions

Integration Considerations:

RBC's Plaid connection works reliably but adds processing time to every payroll cycle. Businesses should plan for the additional settlement delay and may need manual oversight during critical payroll windows to ensure timely employee payments.

3. TD Basic Business Plan

Budget Option for Low-Volume Payroll

TD's Basic Business Plan connects with Rippling through Plaid, offering an entry-level option for very small teams. The low monthly fee attracts startups, but transaction limits quickly become problematic as payroll frequency increases.

The account restricts you to just five free transactions monthly before charging $1.25 each. For bi-weekly payroll with even a small team, these fees accumulate rapidly. The lack of pre-authorized debit features also limits benefits administration capabilities through Rippling.

Key Features:

• Plaid-enabled Rippling connection

• $5 monthly fee

• 5 free transactions, then $1.25 each

• Limited to CAD only

• No pre-authorized debit features

Integration Considerations:

Transaction limits create friction for growing payroll operations. Each employee direct deposit counts against your monthly allowance, making this account unsuitable for teams beyond 2-3 people on bi-weekly payroll.

4. Wise Business Account

International-First Option With Limited Rippling Support

Wise built its reputation on low-cost international transfers, offering 40+ currencies with competitive exchange rates. The platform connects to Rippling through Plaid, though users report occasional connectivity issues requiring manual re-authentication.

The account excels at international wire transfers but lacks Canadian-specific features essential for local payroll operations. No Interac e-Transfer® support means you cannot pay Canadian contractors or vendors who expect this standard payment method.

Key Features:

• Plaid integration (with occasional connectivity issues)

• 40+ currency support

• Low FX fees (0.4-0.6%)

• No monthly account fees

• No Interac e-Transfer® support

Integration Considerations:

While Wise excels at international transfers, it's not optimized for Canadian payroll operations through Rippling. The lack of local payment rails and occasional Plaid disconnections create friction for regular payroll processing.

How Rippling Connects to Business Bank Accounts in Canada

Understanding how Rippling connects to your business account helps set realistic expectations for integration reliability and settlement speeds.

Most Canadian banks connect to Rippling via Plaid, a third-party financial data aggregation service. Plaid acts as an intermediary, providing Rippling with read access to transaction data and limited write access for payment initiation. This extra layer can introduce connection failures or require periodic re-authentication.

Direct banking API integrations offer superior reliability and speed but remain rare in Canada. These connections eliminate the middleman, enabling real-time data exchange and faster payment processing. Venn's infrastructure provides direct EFT and ACH rails alongside Plaid connectivity, offering the best of both approaches.

Settlement timing varies significantly between providers. Traditional banks using Plaid typically add 1-2 business days to every transaction. Modern platforms with direct banking rails can achieve same-day or next-day settlement, ensuring employees receive pay on schedule.

Pre-authorized debit support proves essential for benefits administration through Rippling. This feature enables automatic deduction of health insurance premiums, retirement contributions, and other benefits directly from your business account. Not all accounts offer this capability, limiting your ability to automate the full payroll and benefits cycle.

Common Integration Challenges:

Failed Plaid connections rank among the most frequent issues, often occurring at critical payroll moments. Manual re-authentication requirements can delay processing if not caught immediately. Some businesses report needing to maintain higher account balances to prevent failed transactions during the multi-day settlement window traditional banks require. Many Fintechs in Canada, such as Float, don't have direct PAD authorization meaning that businesses are unable to run payroll out of their business bank account. A vital flaw and pain for finance teams.

Why Venn Is the Best Business Account for Rippling Users in Canada

Venn built its infrastructure specifically to address the limitations Canadian businesses face with traditional banking. By developing custom rails on top of Peoples Trust Bank, Venn provides direct EFT capability, pre-authorized debits for benefits, and settlement speeds that traditional banks cannot match.

For businesses managing teams across borders, Venn provides real local accounts in CAD, USD, GBP, and EUR. The US account supports true ACH transfers, not the SWIFT-based transfers that masquerade as US accounts at traditional banks. This eliminates the $17+ inbound wire fees that accumulate quickly for businesses receiving US payments or running US payroll through Rippling.

Unlike Float's per-user pricing or traditional banks' transaction fees, Venn charges per account, not per employee. Combined with free unlimited Interac e-Transfers®, 1% unlimited cashback on all card spending, and native QuickBooks/Xero sync, Venn eliminates the friction and hidden costs that accumulate with other providers. The multi-currency card automatically selects the correct currency for each transaction, avoiding unnecessary conversion fees.

Conclusion

Choosing the right business account transforms Rippling from a promising HR platform into a genuine competitive advantage. The difference between same-day and multi-day settlement, between reliable and failing integrations, directly impacts your team's financial wellbeing and your operational efficiency.

While traditional banks offer familiar brands and branch networks, their infrastructure wasn't built for modern payroll automation. Fintech alternatives provide better technology but often lack essential features like pre-authorized debits or local payment rails. Venn bridges this gap with purpose-built infrastructure that delivers both innovation and reliability, making it the optimal choice for Canadian businesses serious about streamlining their Rippling payroll operations.

Sign up for your Venn business account today

Frequently Asked Questions About Business Accounts and Rippling in Canada

Does Rippling work with all Canadian business bank accounts?

A: Rippling connects to most Canadian banks through Plaid integration, but connection reliability and settlement speeds vary significantly. Accounts with direct banking rails and pre-authorized debit capabilities (like Venn) work best for ensuring smooth and reliable payroll operations.

Can I use Rippling for payroll with a US business account?

A: For Canadian payroll, you absolutely need a Canadian business account with EFT capability to remit to the CRA and pay employees in CAD. However, if you have cross-border employees, accounts like Venn that provide both real Canadian and real US accounts enable seamless multi-country payroll management directly through Rippling.

What happens if my bank integration fails during payroll processing?

A: Failed integrations can delay critical payroll funding and require immediate manual intervention, leading to potential employee dissatisfaction and fines. Choosing an account with reliable Plaid connectivity and direct banking rails (like Venn) minimizes this risk. Always test your integration before your first live payroll run.

Do I need a separate account for Rippling payroll and business operations?

A: No. Modern business accounts like Venn are designed to consolidate financial functions. They integrate seamlessly with Rippling for payroll while simultaneously handling your expense management, vendor payments, and daily operations, eliminating the need for multiple banking relationships and simplifying reconciliation.

How do multi-currency accounts work with Rippling?

A: If you run multi-country payroll in various currencies through Rippling, having a multi-currency business account eliminates unnecessary conversion fees and delays. Venn's dedicated CAD, USD, GBP, and EUR accounts enable direct-currency payroll funding without triggering internal bank FX markups.

---

**Disclaimer:** This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Venn Software Inc or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.