ACH Vs. EFT: Key Differences for Your Business Transactions

Are you using the right transfer type for your business payments? For Canadian businesses managing payroll, vendor payouts, and global transfers, choosing between ACH vs. EFT might seem like splitting hairs. However, these differences can significantly impact your cash flow management, costs, and even your payment processing speed.

Trusted by 5,000+ Canadian businesses

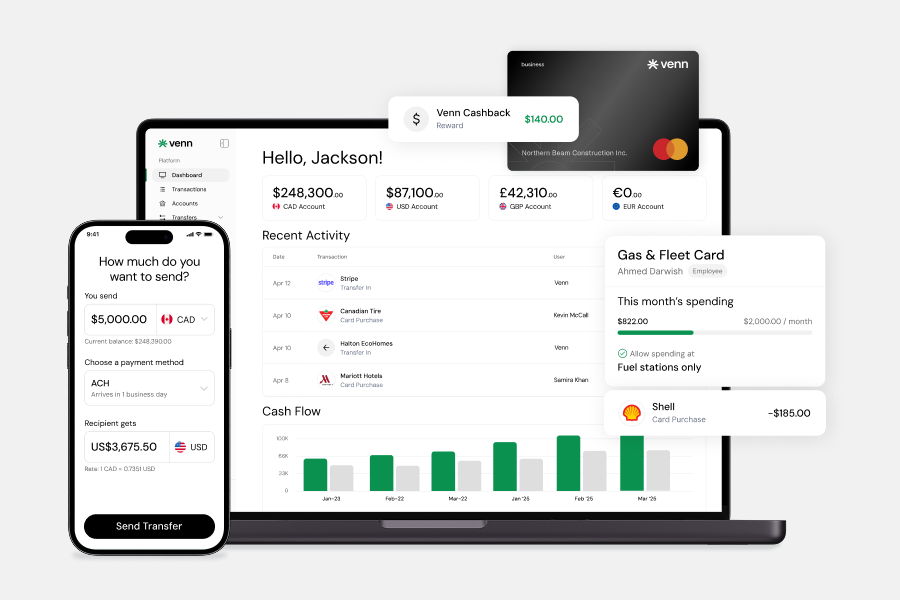

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

Are you using the right transfer type for your business payments?

For Canadian businesses managing payroll, vendor payouts, and global transfers, choosing between ACH vs. EFT might seem like splitting hairs. However, these differences can significantly impact your cash flow management, costs, and even your payment processing speed.

In general, EFT (Electronic Funds Transfer) refers to any electronic method of transferring money between accounts. At the same time, ACH (Automated Clearing House) is a type of EFT that transfers money in batches through a secure network.

In this guide, we’ll help you understand the differences between EFT and ACH and know which type of payment transfer is best suited for your business needs.

ACH Vs. EFT: Key Differences

EFT is an umbrella term for any electronic method of transferring money from one account to another, including wire transfers, ATM withdrawals, credit card payments, direct deposits, and eWallets. ACH, on the other hand, is a specific kind of EFT that moves funds electronically between financial institutions in batches.

Here’s a simple side-by-side comparison to help make it clearer:

In general, EFT broadly refers to electronic payments. However, in Canada, financial platforms like Venn use “EFT” to mean CAD-to-CAD domestic transfers only. EFT in Canada refers to electronic transfers between Canadian financial institutions, using the Automated Clearing Settlement System (ACSS), for payroll, vendor payments, and bill payments.

Simply put, EFT in Canada, not to be confused with the general EFT terminology, is the equivalent of local ACH in the United States.

How ACH Payments Work

When you send an ACH payment, it gets added to a queue with other transactions. The bank processes these transfers in batches, which means that the money is not sent in real time.

The bank settles and clears these payments altogether after the cut-off time and date on the same day or in 1 to 3 days, depending on the provider. Because the transaction is not real-time, banks often offer this transfer for free or at a minimal cost. In Canada, the US-specific term ‘ACH’ is known as ‘batch-based EFTs.’

If you're paying a team or sending vendor deposits, ACH is a smart way to reduce transaction costs and stay consistent.

Even better, payment platforms like Venn enable you to automate payment systems, saving time and improving cash flow visibility. You can schedule recurring transfers, set up customisable approval rules, and sync all activity with accounting software, such as QuickBooks and Xero, for faster reconciliation and fewer manual steps.

Benefits of ACH

- Offers cost-effective solutions when savings matter more than speed

- Provides a reliable transfer method that’s safe and secure, processed through ACSS in Canada and governed by Payments Canada.

- Ideal for automated, repeatable payments between Canadian bank accounts

Limitations of ACH

- Longer processing times, typically within 1 to 3 business days, compared to other EFT methods

- Limited to local transfers only, although some providers allow international ACH transfers (IATs) to select countries.

While ACH payments may have limitations, payment platforms like Venn offer a solution to this. Venn allows you to send ACH payments within 0-1 business day, making it a fast and more reliable option for those who prefer ACH payments.

How EFT Payments Work

By the dictionary, EFTs cover a wide range of electronic transfer methods. They can be real-time, scheduled, or batch-based, depending on the type of transaction you're processing.

Examples of EFT payments include:

- Wire transfers for larger, time-sensitive payouts

- Scheduled vendor payments via EFT or ACH

- Peer-to-peer or mobile payments like Interac e-Transfer® for business-to-business transactions

- Debit card and credit card transactions

- ATM withdrawals

EFTs can provide fast fund transfers even across borders and are a great option for one-off payments, withdrawals, or mobile bank transfers.

In Canada, international payments are not categorised as EFTs and are handled via separate rails, such as SWIFT, Fedwire, SEPA, and UK Faster Payments, but they act the same way as the common terminology.

Venn leads as one of the most trusted Canadian providers for electronic transactions, supporting 180+ countries and 36 currencies. You can send EFTs and ACHs for $0-$2, compared to the Big Banks that charge $20-$30, validate the transfer, and track it in your Venn dashboard, whether you’re paying a freelancer in the UK or funding your US marketing account.

If you're currently using a different platform like Wise, Venn gives you local control, faster settlement times, and full accounting integration.

Interested in learning more about some of the best bank accounts for Global Payments in 2025? Read our blog on the topic here!

Benefits of EFT

- Can provide real-time payments to help settle urgent transactions quickly and efficiently

- Enables electronic payments anytime, from anywhere

- Supports international transactions using SWIFT, SEPA, Fedwire, etc.

Limitations of EFT

- Some EFT methods (e.g., wire transfers) often come with higher fees

- Security can vary depending on the method/provider

Comparing ACH, EFT, and Other Payment Methods

86% of total payment volume and 75% of total payment value in Canada are now digital. Among several payment methods, which one should you use for your business?

Choosing the right payment method depends on your priorities. Do you value speed? Is cost more important? Are you making international transfers or local vendor payments?

This table highlights the key differences between ACH, EFT, and other popular payment methods to help you decide which is best for your business.

Payment Methods at a Glance:

Each payment method has its strengths. What works for one business might not work for another. Ideally, businesses use the following:

- EFTs, such as online banking transfers and mobile payments, are perfect for businesses that need to perform quick payments.

- ACH, or batch-based EFTs in Canada, serve similar purposes: low-cost, automated payments like payroll and vendor payouts.

- Wire transfers, a type of EFT, are best for large, urgent payments, especially across borders, but they come with higher fees.

- Credit and debit card transactions, a type of EFT, are useful for instant transactions and managing expenses, but you can end up paying high processing fees.

- Platforms like PayPal and Stripe facilitate EFT transfers and are great for e-commerce and client invoicing, but they may charge percentage-based fees that eat into your margins.

If you're tired of juggling tools, paying high fees, or waiting days for funds to clear, Venn offers a better way.

Venn combines ACH, EFT, and wire transfers into one secure platform, built specifically for Canadian businesses. Venn also lets you send global transfers easily. Hold and send funds in CAD, USD, GBP, and EUR with faster settlement times to save on fees, avoid delays, and stay in control of your payments.

Regardless of whether you’re a startup, a growing mid-size business, or a large enterprise, Venn delivers low-cost, reliable payments that scale with you, so you can skip the admin work and stay focused on growth.

How to Make ACH and EFT Transactions with Venn

Venn gives you one simple, secure platform to initiate, authorise, and track every transfer. Here’s how to make an outgoing transfer with Venn:

- Go to the ‘Recipients’ tab and select the vendor you’ll be sending money to.

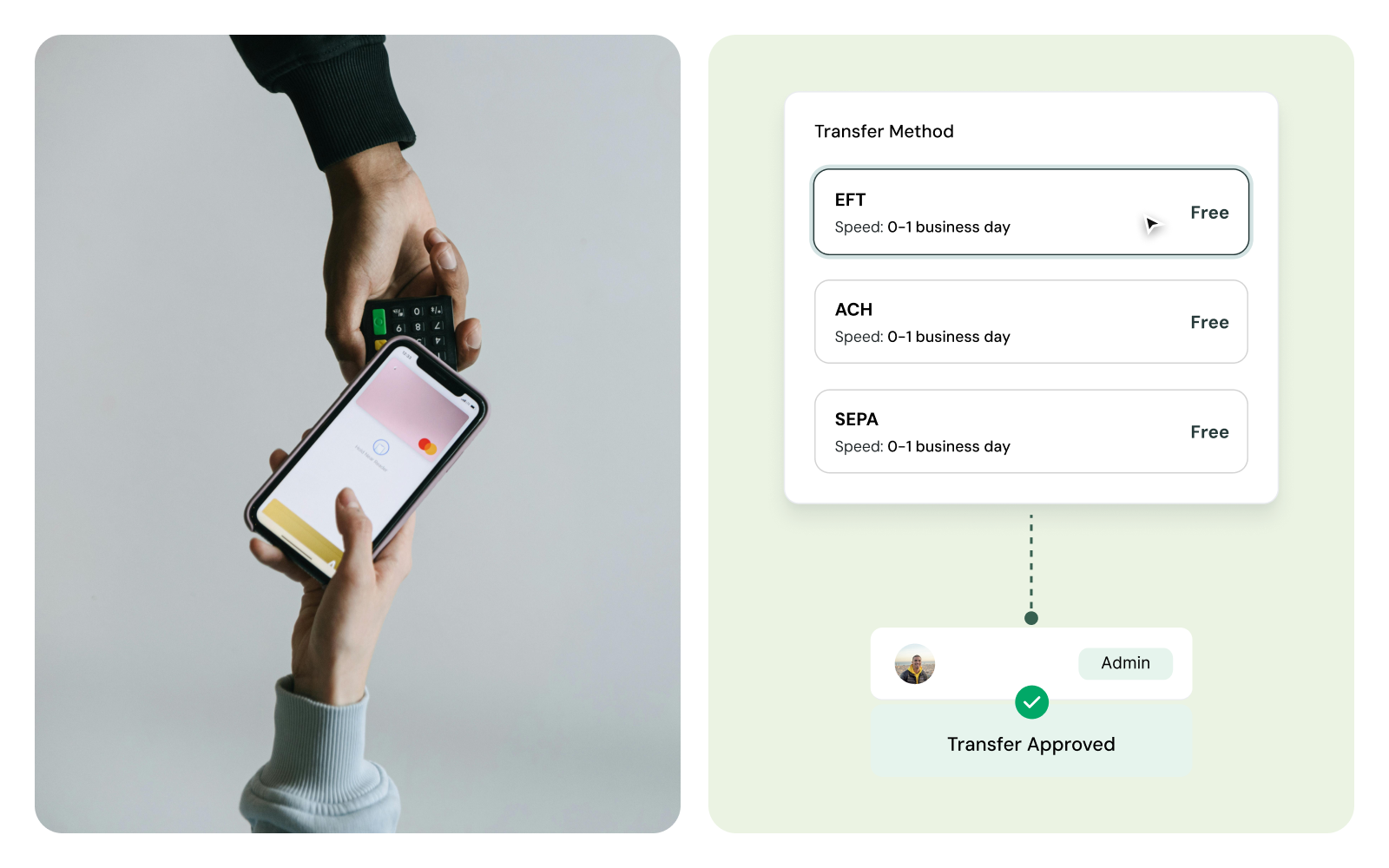

- Add your vendor’s accounts in the ‘Payment Method’ section (ACH, SWIFT, EFT, Interac e-Transfer®, Fedwire, SEPA, etc.)

- Click ‘Send Transfer’ and select ‘One Time Transfer’ or ‘Scheduled Transfer.’

- Upload your invoice (optional).

- Select which payment method you’ll be using (e.g., ACH, EFT, SWIFT, etc.).

- Enter the amount you want to transfer and click ‘Continue.’

- Enter your reference or invoice number and type in your recipient’s email address for the transfer confirmation email.

- Click ‘Send Transfer.’

Again, the ‘EFT’ payment method in Venn refers specifically to CAD-to-CAD domestic transfers via the ACSS, not to be confused with the general meaning of EFTs. For cross-border or multi-currency payments, use SWIFT or wire transfers.

Venn Integration with Accounting Platforms

Venn also integrates with accounting systems like QuickBooks and Xero, allowing you to automate payment systems, sync transaction data quickly, and improve cash flow management with zero manual entry.

That level of control made a big difference for Corey Janvier, founder of Cedar Brush in West Vancouver, who struggled to separate personal and business finances without relying on risky credit. Venn gave him the flexibility that traditional banks couldn’t.

"When you're starting out and you're focused on growth, you don’t want to be dealing with credit cards or bank cards that have no control. It becomes a risk, especially when you have multiple divisions within the company and every purchase matters.”

- Corey Janvier, Cedar Brush CEO

With Venn, Corey was able to issue corporate cards, set spending limits by team, and automate expense tracking. This helped him grow without relying on personal credit or taking on unnecessary risk.

Key Takeaways:

- In general, EFT is the broader term for all electronic fund transfers, while ACH is a specific type of EFT that processes payments in batches.

- ACH or batch-based EFT in Canada is best for low-cost, automated payments like payroll or vendor deposits, whereas the common terminology EFT offers quick payouts and supports international transactions.

- Venn combines the benefits of multiple payment systems, including ACH, EFT, and wire transfers, into one secure, cost-effective platform built for Canadian businesses.

Ready to simplify your business payments?

If you're running payroll, paying global vendors, or managing domestic transfers, Venn gives you a smarter way to move money. Eliminate the guesswork, reduce fees, and stay in control with one secure platform built for Canadian businesses.

Frequently Asked Questions (FAQs)

Q: Can you track an ACH payment?

Yes. You can track an ACH payment, but not in real time. Banks and payment processors provide status updates (e.g., "initiated," "processing," or "settled"). Platforms like Venn allow you to track your ACH transactions directly in the dashboard, offering better visibility than traditional banks.

Q: How much does it cost to use ACH transfers?

Traditional Canadian banks often charge high fees for cross-border payments (around $20–$30) which they may mislabel as ACH, but are actually costly wire transfers. Platforms like Venn offer genuine, low-cost ACH: it is free for Plus and Pro plans, or costs a low fee (e.g., $2) per transaction on the Essentials plan, making it a significantly more cost-effective option for US payments.

Q: Can ACH payments be reversed?

Yes. ACH payments can be reversed, but only under specific circumstances like a transaction error, a duplicate entry, or confirmed fraud. The originating bank must submit a formal reversal request according to NACHA guidelines and notify the recipient.

Q: Can you automate your business payments using ACH?

Yes. ACH is widely used for business automation. Businesses can automate ACH payments by setting up recurring schedules for payroll, regular vendor invoices, and subscriptions. Platforms like Venn support automated ACH processing integrated with accounts payable workflows to greatly reduce manual tasks and ensure timely payments.

Q: Can you send money online via EFT?

Yes. Electronic Funds Transfer (EFT) is the broad term for sending money online through various electronic systems. In the Canadian context, this includes bank-to-bank transfers and systems like Interac e-Transfer®. Platforms like Venn support Interac e-Transfer® for fast, secure local payments between Canadian entities once the necessary setup is complete.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.