Venn vs Wise for Corporate Cards

So, which corporate card is better: Venn or Wise? Let’s dig into the differences between Venn and Wise corporate cards and see how Venn and Wise corporate cards compare for Canadian business owners.

.png)

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

For business owners in Canada, a corporate card is more than a payment method. It helps streamline operations, improve expense management, and increase visibility into transactions. Choosing the right provider involves considering global payments, foreign exchange rates, spend controls, and integrations with accounting software such as QuickBooks and Xero.

Venn and Wise are two popular financial services platforms in this space.

Venn is an all-in-one business banking platform with multi-currency accounts, corporate cards, and advanced tools for managing vendors, suppliers, and team spending. Wise, known for its global money transfers, also offers business accounts and cards for international payment processing.

So, which corporate card is better: Venn or Wise? Let’s dig into the differences between Venn and Wise corporate cards and see how Venn and Wise corporate cards compare for Canadian business owners.

Venn vs. Wise for Corporate Cards: Side-by-Side Comparison

How to evaluate Venn vs Wise corporate card features begins with comparing core areas like corporate cards, multi-currency accounts, FX rates, expense management, and global payments.

The table below outlines the main differences to help you choose the best fit for your business.

Feature: Corporate Cards for Business Expenses

How Venn and Wise corporate cards support business expenses comes down to features and integration. Venn offers deeper controls, automation, and multi-currency capabilities, while Wise focuses on simplicity and low-cost international use.

Venn

The benefits of Venn corporate cards over Wise include multi-currency accounts linked to physical and virtual cards, allowing transactions in CAD, USD, GBP, or EUR without extra FX fees and all managed through a single card.

Venn offers 1% cashback on all spend with no minimum, boosting cash flow and savings. Spend controls enable business owners to set limits, approve purchases, and track spending in real-time, while instant issuance equips team members, freelancers, or contractors in minutes.

You can also compare Venn’s corporate features with Loop through our detailed comparison.

Wise

Wise cards work well for low-cost international transactions but require linking to external banks for some currencies. Wise cards have a small upfront fee, but the lack of rewards or cashback limits their long-term value. They also offer fewer built-in features for control, visibility, and reporting than Venn.

Which card offers better integration with accounting software? If you use QuickBooks or Xero for your business, Venn's two-way sync and automated categorization make it a better choice over Wise's more basic connection.

Feature: FX Rates & Global Transfers

How Venn and Wise corporate cards handle international transactions affects predictability and budgeting.

Venn

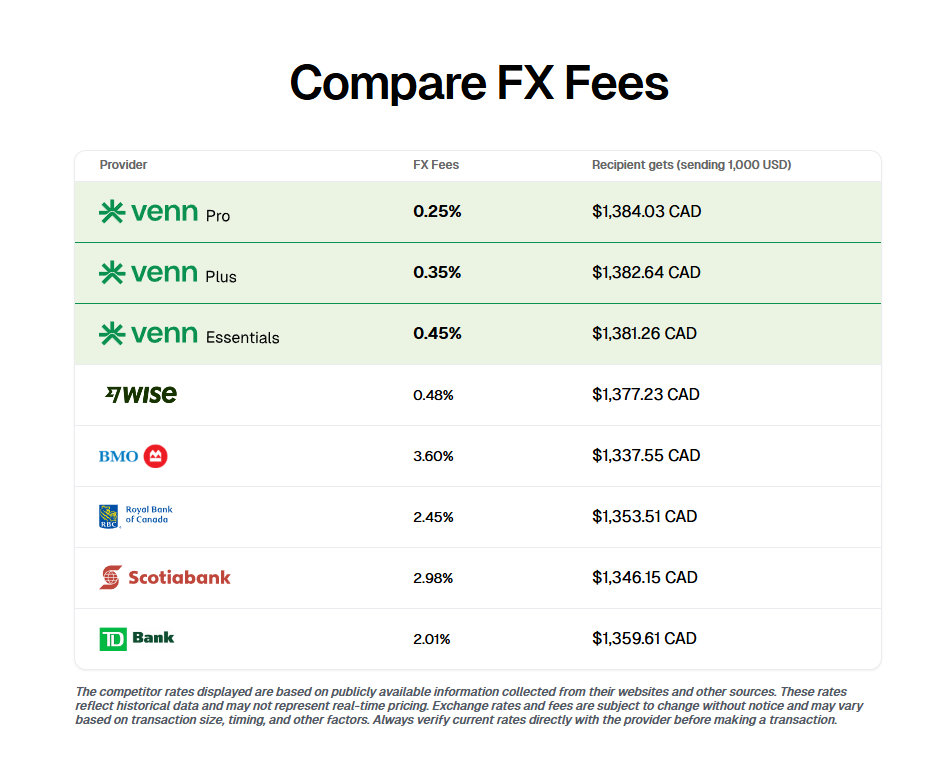

Venn offers transparent FX rates starting at just 0.25% on the Pro plan*, making it cost-effective for frequent international transactions. Businesses can make payments to more than 180 countries in over 36 currencies through EFT, ACH, SEPA, UK Faster Payments, wires, and Interac e-Transfer®. Canadian businesses also benefit from local payment rails and faster delivery times.

Wise

Wise supports over 50 currencies with FX fees typically ranging from 0.35% to 2.5%, depending on the currency and transaction size. Transfers are available to 160+ countries, but they lack local payment options like Interac e-Transfer® and PAD, which may limit flexibility for Canadian businesses.

Feature: Pricing and Fees

The fees associated with Venn and Wise corporate cards directly affect budgeting and cash flow, which are important when comparing pricing models to find the best fit for your business.

Venn

Venn offers three plans:

- Essentials ($0/month) for all core features, cards and multi-currency support;

- Plus ($40/month) adds expense automation, custom roles, and receipt collection;

- Pro ($100/month) includes priority support, advanced reporting, and Venn’s lowest FX rates starting at 0.25%.

All plans include cards with 1% cashback, and local and international transfers, and no hidden fees, offering predictable costs for growing businesses.

Wise

Wise charges no monthly fees and uses a pay-per-use model, with FX rates typically ranging from 0.48% to 2.5%, depending on the currency and transaction size. Check the current USD to CAD rate with our currency converter.

While it’s cost-effective for occasional use, variable fees can make it more challenging for businesses with frequent international transactions or corporate card usage to forecast costs accurately.

Venn vs. Wise: Who Offers Better ROI?

Venn: Strengths & Considerations

Pros:

- True All-in-One Financial Platform

- Integrated Multi-Currency Accounts (CAD, USD, GBP, EUR)

- Customizable Corporate Cards and Expense Management

- 1% Unlimited Cashback on Card Transactions

- Robust Automated Expense Management

- 2% interest on all CAD/USD balances

- Strong Automated Accounts Payable (AP) Features

- QuickBooks and Xero Integrations

- Competitive FX Rates and Global Transfer Capabilities

- Transparent Pricing with No Hidden Fees

- Invoicing and Credit Card Payments Integration

Cons:

- Limited Lending and Credit Facilities

- Only avaliable to Canadian businesses.

Wise: Strengths & Considerations

Pros:

- Affordable Cross-border Payment Options

- Multi-currency Accounts Supporting Over 50 Currencies

- Transparent Pricing with Low FX Fees

- Efficient Global Transfers

- Quick Setup for Business Accounts

Cons:

- Higher FX fees than Venn and no cashback

- Not an All-in-One Financial Platform

- No Corporate Credit Cards or Spend Management Features

- Requires External Accounts for Certain Currencies (e.g., CAD)

- Limited Financial Automation Features (compared to Venn)

Which Platform is Right for Your Business?

How to choose between Venn and Wise for corporate card solutions depends on your priorities and how you manage spending, cash flow, and transactions.

- Venn: Offers multi-currency support, global payments, and advanced expense management with 1% cashback on all spending, no minimums, and integration with QuickBooks and Xero. Ideal for Canadian SMBs with international contractors, with instant card issuance, spend controls, and ACH/EFT payments without extra FX fees. Venn also supports sole proprietorships, making it easier for freelancers and self-employed Caanadians to access modern financial tools.

- Wise: Provides cost-effective international transactions without monthly fees and a simple platform for cross-border payment processing. Best for freelance agencies needing basic corporate cards linked to multiple currencies.

- Mid-size eCommerce: Venn delivers the tools to manage cash flow, earn rewards, and maintain tight control over expenses.

Choose Venn for a full-featured fintech platform or Wise for a lean alternative focused on low-cost FX and payments. You can also explore how Venn compares to Float in our Venn vs Float for Corporate Cards guide.

Ready to Transform Your Business Finances with Venn?

Experience a corporate card built for Canadian businesses with multi-currency support, 1% unlimited cashback, advanced spend controls, and seamless integration with QuickBooks and Xero.

Streamline payments, optimize cash flow, and gain full visibility over your business operations in minutes.

Learn more about Venn’s corporate card solution and see how fast you can get started.

Frequently Asked Questions (FAQs)

Does Venn provide more flexibility for businesses with international employees or contractors?

Yes. Venn equips businesses with physical and virtual cards that feature instant issuance, customizable limits, and real-time tracking, enabling the management of remote teams or international contractors.

Which platform is better for global transfers?

With more currencies and transfer methods, including EFT, ACH, SEPA, and low-cost SWIFT/wire payments starting at $6–10, Venn is better suited than Wise for handling frequent or large international payments.

Is Venn’s corporate card suitable for businesses with complex financial needs?

Yes. Venn’s multi-currency accounts, corporate cards, expense management tools, and integration with QuickBooks and Xero make it a complete solution for complex financial services needs. Wise is strong for cross-border payment processing but does not offer the same breadth of features.

Does Venn offer any advanced controls for managing employee corporate card spend?

Yes. Venn delivers tracking, custom limits, multi-step approvals, and instant card issuance for advanced spend control. Wise lacks these deeper management features.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Venn Software Inc or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.