Sole Proprietorship vs Corporation: How To Choose in Canada

Choosing between a sole proprietorship and a corporation is one of the first real decisions Canadian founders face. It affects how you pay taxes, how much risk you carry, and how ready your business is to grow. This guide explains the differences in plain language and shows how Venn now lets you incorporate and open your business account in one simple flow.

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

Most Canadian founders face this decision early. It determines how you pay taxes, manage risk, and grow. It also affects how clients, lenders, and investors perceive you.

This is a practical guide to help you pick the right structure now and position yourself for later.

What a Sole Proprietorship Actually Is

A sole proprietorship is the most straightforward way to start a business in Canada. You are the business. The income flows directly to you, and you’re personally responsible for everything that happens.

Registration is fast and cheap through your province. You can operate under your own name or a registered trade name. You report taxes on your personal return and claim expenses against that income.

That simplicity is what makes it appealing. But if the business gets sued or racks up debt, your personal savings and property are on the line. The structure works well for freelancers, independent contractors, and small operators who want to start quickly without admin overhead. Venn also supports sole proprietorships, making it easier for freelancers and self-employed Canadians to access modern financial tools.

How Incorporation Changes Things

When you incorporate, the business becomes its own legal entity. It can own assets, sign contracts, and pay taxes separately from you. You own shares and pay yourself through salary, dividends, or both.

Incorporation costs more upfront and requires more paperwork, but it comes with benefits that sole proprietorships can’t match. You get limited liability protection, access to corporate tax rates, and the ability to build credibility with clients and partners.

If you plan to hire, scale, or raise capital, incorporation creates the foundation for that growth.

Sole Proprietorship vs Corporation: Comparing the Two Structures

The main trade-off is between simplicity and protection. Here's exactly how the two options compare:

Taxes and Compliance

Sole Proprietorship Taxes

All business income counts as personal income. You report it on your personal tax return using the T1 form. As your income grows, so does your tax rate.

If you earn more than $30,000 in a 12-month period, you must register for a GST/HST account under the Canada Revenue Agency’s guidelines.

This setup works well at lower income levels because it keeps tax filing simple. The downside is that you can’t retain earnings in the business, and you have no separation between your personal and business liabilities.

Corporate Taxes

Corporations file a separate tax return (T2) and pay tax at the corporate rate, which is often much lower than personal rates. The first $500,000 in active business income generally qualifies for the small business deduction, which reduces the tax rate further.

Founders can decide whether to draw income as a salary, dividends, or a mix of both, allowing for flexibility in tax planning. The corporation can also retain profits to reinvest in growth instead of distributing them immediately.

While this requires more accounting support, the long-term tax efficiency usually outweighs the extra admin once revenue is consistent.

Liability and Risk

This is where incorporation makes the biggest difference.

A sole proprietor is personally liable for all business obligations. That includes unpaid invoices, legal claims, and outstanding debts.

A corporation creates a layer of protection between you and the business. If something goes wrong, creditors and legal actions are directed at the corporation, not your personal assets. For anyone hiring staff, taking on contracts, or managing client funds, that separation can protect everything you’ve built personally.

Cost, Administration, and Control

Registering a sole proprietorship is quick and inexpensive. Most provinces let you file online in minutes for under $200.

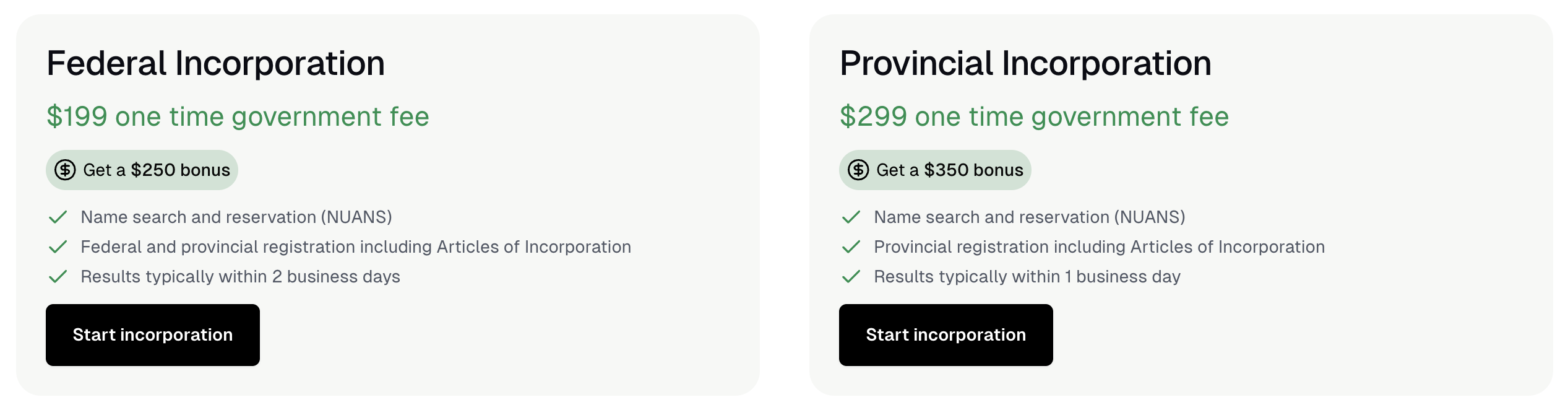

Incorporation costs slightly more. Federal registration is $199 and most provincial filings are around $299. Those are one-time government fees, not ongoing costs. The bigger difference comes afterward. Corporations need to file annual returns, keep corporate records, and manage a separate business account.

That used to mean hiring an accountant and visiting a branch every time you needed to change something.

Venn makes the process much easier. You can now incorporate and open your business account in one flow, without paperwork or branch visits.

When you incorporate through Venn, you:

• File fully online and receive your official Articles of Incorporation by email.

• Get your Venn business account opened automatically once approved.

• Access dedicated CAD and USD accounts built for Canadian businesses.

• Earn up to $350 as a welcome bonus when you fund your new account.

This setup keeps your business and personal finances separate from day one and gives you the same limited liability and tax advantages as any other corporation.

Once incorporated, you can manage everything inside the same platform: accounts, global transfers, corporate cards, and automated reconciliation. That means compliance stays handled, and your finance workflow doesn’t slow down as you grow.

When a Sole Proprietorship Makes Sense

Many founders start here to move fast. A sole proprietorship works when you:

- Are testing an idea or freelancing

- Have limited financial risk

- Want the lowest cost and least paperwork

You can always incorporate later once your business grows or generates steady profit.

You’ll still need to watch the GST/HST threshold; once your revenues cross $30,000 within the CRA timelines, registration and charging tax are mandatory.

When Incorporation is the Better Move

Incorporation makes sense when:

- You're earning a consistent income and want lower taxes

- You plan to hire or raise investment

- You need to protect personal assets from business risk

- You want credibility with clients or lenders

The shift usually happens once you hit stable revenue and start thinking about long-term structure.

How to Transition Cleanly

Many founders start as sole proprietors and decide to incorporate once the business grows. The good news is that the process is simpler than it used to be! With Venn Incorporation, you can handle everything in one place—incorporation, accounts, and setup—without dealing with multiple websites or branch visits.

Here’s how the transition works:

1. Start online: Enter your business details, choose federal or provincial incorporation, and complete the form in minutes.

2. Get your documents: Venn files the paperwork and delivers your official Articles of Incorporation straight to your inbox.

3. Launch ready: Your new CAD and USD business accounts are opened automatically once approved. You can send, receive, and hold funds immediately.

4. Fund and earn: Load at least $100 to your new account and receive up to $350 as a welcome bonus.

5. Keep operations simple: With invoicing, payments, and expense tools in the same platform, you can manage everything without adding new systems or admin work.

For founders who started as sole proprietors, this makes the upgrade to a corporation clean, fast, and automated. You stay compliant, keep your finances separate, and can focus on building the business instead of managing paperwork. Here's what you can expect after incorporating in Canada.

Example: A Growing Agency

A one-person creative shop in Toronto starts as a sole proprietorship. A year later there’s a team, recurring retainers, and a U.S. client. Payroll, FX, and bigger contracts raise the stakes. At that point, incorporation provides liability protection and better tax planning.

The agency can then use Venn to issue corporate cards, manage AR/AP, and move funds in CAD and USD with clean accounting sync.

Common Misunderstandings

“You need employees to incorporate.” A corporation can have a single shareholder.

“Incorporation always lowers taxes.” The benefit depends on your profits, compensation mix, and any associated corporations; model it first.

“Setting up is difficult.” Not anymore! With Venn, you can incorporate, open your business account, and start sending payments within a day.

A sole proprietorship keeps you light but leaves you exposed. Incorporation adds structure, separates risk, and gives you the tax and credibility advantages you’ll want as revenue grows.

A good rule of thumb: Pick the structure that matches your current risk and the next 12–24 months of growth.

Whichever path you choose, put tight financial operations in place early. Venn brings accounts, cards, payments, invoicing, FX, and accounting sync into one platform so your structure supports growth instead of slowing it.

Frequently Asked Questions (FAQ)

Q: Can I switch from a provincial to a federal corporation later?

Yes. You are not locked into your initial choice. The legal process for moving your corporation from a provincial jurisdiction to the federal one is called continuance. This allows your company to change the laws governing it without dissolving or starting a new company. It is a formal process that requires shareholder and board approval, and is typically handled by an accountant or lawyer to ensure all tax and legal requirements are met during the transition.

Q: What happens to my old business number when I incorporate?

If you were previously operating as a sole proprietor, your old Business Number (BN) was tied to you personally. When you incorporate, you create a new, separate legal entity—the corporation—which must obtain its own unique BN from the Canada Revenue Agency (CRA) for its corporate tax, GST/HST, and payroll accounts. Tools that combine incorporation and banking, such as Venn, automatically facilitate this process and connect the new BN to your new business account.

Q: Can I keep using my personal account after I incorporate?

No, you should not. Once your business is incorporated, it is legally recognized as a separate entity from you, the owner. Using a personal account for corporate transactions risks piercing the corporate veil, which can expose your personal assets to business liabilities. A separate business account is required by law to maintain the corporation's legal integrity, simplify tax reporting, and prevent complications during a potential CRA audit.

Q: What if my business operates in multiple provinces?

If you plan to physically operate, have employees, or maintain offices outside of your home province, you must register your corporation in those additional provinces. This is called extra-provincial registration. Choosing federal incorporation is often recommended, as it secures your business name across Canada and generally streamlines the process of registering extra-provincially in the future compared to a provincial-only incorporation.

.png)

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Venn Software Inc or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.