How Many Currencies Can You Send and Receive with Venn?

Global payments shouldn’t force your team into workarounds. With Venn, Canadian businesses receive money in four core currencies and send payments in 33 more, all from one place. Fewer conversions, fewer tools, and full control when money moves across borders.

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

Running a modern business almost always means moving money across borders. Paying overseas contractors, settling supplier invoices, funding international subsidiaries, or sending customer refunds in local currency is no longer a “global company” problem. It’s a standard operating requirement for Canadian SMBs.

Venn is built with that reality in mind.

Today, businesses on Venn can send money in 33 different currencies worldwide, while receiving funds in four core currencies: CAD, USD, GBP, and EUR. That structure gives teams the flexibility to pay globally without turning their financial stack into a patchwork of tools, FX workarounds, and reconciliation headaches.

The Two Sides of Multi-Currency Money Movement

It helps to separate global payments into two distinct jobs:

- Receiving money into your business

- Sending money out to the rest of the world

Venn is intentionally designed to handle both, but in different ways.

Receiving Funds: Keep It Clean And Local

Venn supports four receiving currencies:

- Canadian Dollar (CAD)

- US Dollar (USD)

- British Pound Sterling (GBP)

- Euro (EUR)

Each of these currencies comes with its own dedicated account details and local rails, so incoming funds arrive in the currency they were sent in, without forced conversion.

That means:

- CAD via Interac e-Transfer Auto Deposit, EFT, or Wire (SWIFT)

- USD via ACH, Fedwire, or Wire (SWIFT)

- GBP via UK Faster Payments or Wire (SWIFT)

- EUR via SEPA or Wire (SWIFT)

For most Canadian businesses, these four currencies cover the majority of inbound use cases: domestic revenue, U.S. customers, European clients, and UK-based partners.

Sending Funds: Where Global Flexibility Matters

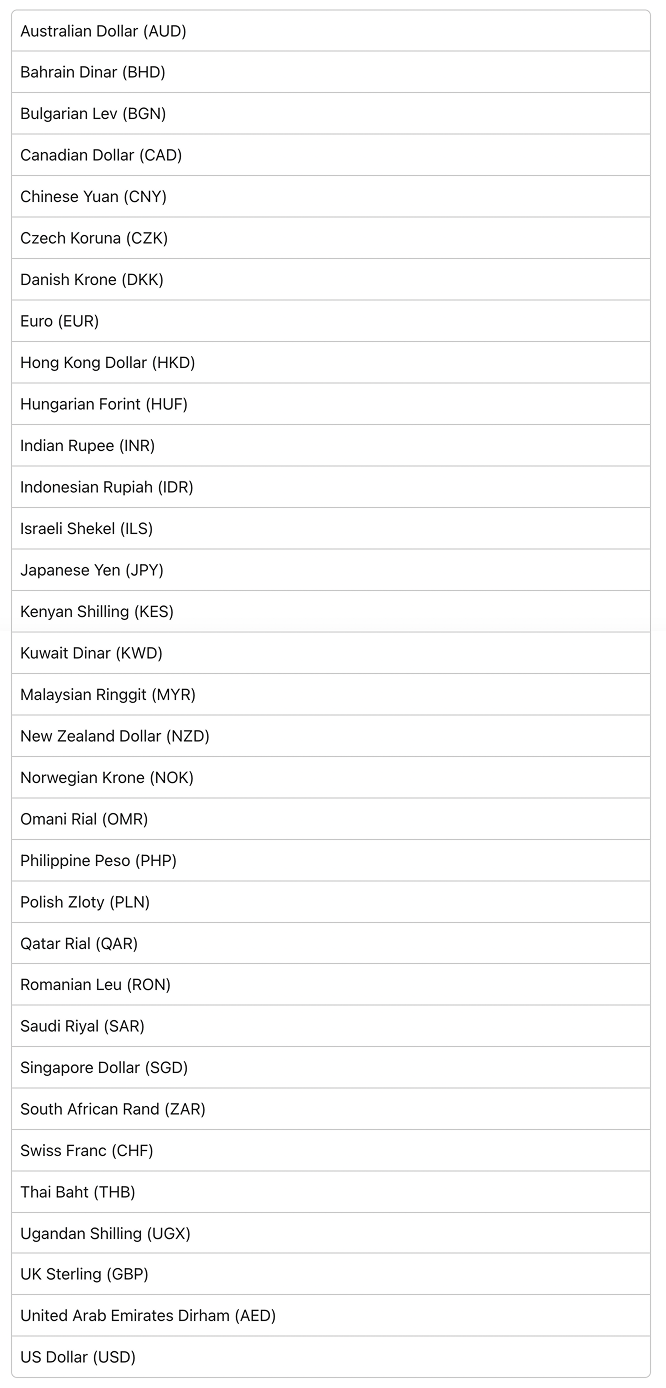

On the outbound side, Venn supports 33 currencies for conversion and international bank transfers. This is where global operations really open up.

This allows finance teams to pay vendors and partners in their local currency, instead of defaulting to USD wires or forcing recipients to handle FX themselves.

Why Venn Separates “Receive” And “Send” Currencies

Some platforms advertise dozens of “supported currencies” without clarifying how they actually work. Often, that means FX-only balances with no real receiving capability, or pooled accounts that complicate reconciliation.

We took a more operational approach:

- Receiving currencies are limited and structured so funds arrive cleanly, predictably, and compliantly.

- Sending currencies are broad so businesses can pay globally without friction.

This separation reduces complexity where it matters most: incoming revenue, payroll funding, and cash forecasting. At the same time, it gives teams the flexibility they need to operate internationally.

This setup maps closely to how Canadian businesses actually operate:

1. Startups with global teams

Private AI uses Venn to move money across North America, Europe, and APAC without rebuilding their finance stack every time the team scales.

2. Creator platforms with cross-border operations

Stan runs teams in Toronto and LA with contractors worldwide, and Venn keeps multi-currency payouts and invoicing from becoming an ops headache.

3. Retail businesses with overseas suppliers

Haydn’s Açaí uses Venn to pay international suppliers while keeping daily spend simple enough to manage solo.

Instead of opening foreign bank accounts or juggling multiple platforms, teams can handle these flows from a single financial system.

FX Without The Operational Mess

Because Venn combines multi-currency accounts, FX conversion, and payments in one place, finance teams avoid several common problems:

- Manually converting funds before sending payments

- Tracking FX rates across multiple tools

- Reconciling international wires with limited context

- Explaining unexplained FX losses to leadership

Funds stay visible, traceable, and auditable from the moment they enter the account to the moment they leave.

A practical way to think about currency strategy

If you’re structuring your business around Venn, a simple rule of thumb helps:

- Receive in the currencies you operate in most

- Send in the currencies your partners prefer

That approach minimizes conversion churn, keeps cash forecasting clean, and reduces friction on both sides of the transaction. You don’t need 33 receiving accounts to run a global business. You need a few strong anchors and the ability to move money out efficiently when it matters. Whether you’re paying a contractor in India, a supplier in Europe, or a partner in the Middle East, you can move money where it needs to go, in the currency that makes sense, without losing control of your cash.

That’s exactly how Venn is designed. Try it out today!

Frequently Asked Questions (FAQ)

Q: Why can I receive funds in fewer currencies than I can send?

A: Venn supports receiving funds into CAD, USD, GBP, and EUR accounts using local rails and wires. Outbound payments support a wider set of currencies because they use conversion and international transfer networks to reach more destinations.

Q: Do I need to open a separate account for each currency I receive?

A: No. Venn provides dedicated CAD, USD, GBP, and EUR accounts within your dashboard. Each currency has its own account details for receiving funds, but everything is managed in one place.

Q: Can I convert received funds before sending them out internationally?

A: Yes. Funds received into your Venn account can be converted between supported currencies and then sent out using international payment rails.

Q: Do senders need to know anything special to pay me correctly?

A: Yes. Senders must use the correct payment rail for the account details you share. Using the wrong method (for example, sending a wire instead of EFT or ACH) can cause the transfer to fail or be delayed.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Venn Software Inc or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.