Corporate Credit Cards in Canada: The Complete Guide for Businesses (2026)

Discover the best corporate credit cards in Canada for 2026. This complete guide helps Canadian businesses compare providers, features, rewards, and compliance tools.

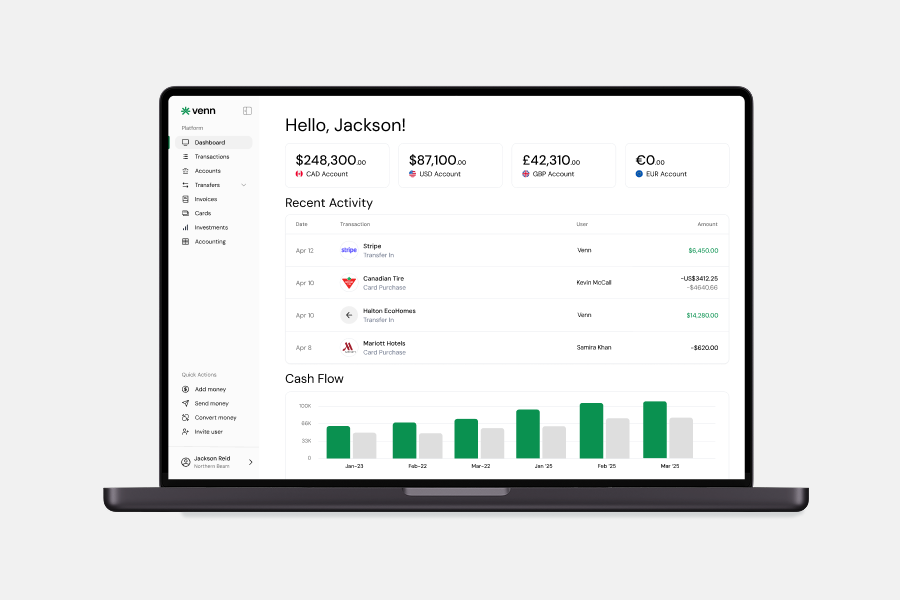

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

Why Corporate Credit Cards Matter for Canadian Businesses

If you're running a business in Canada, choosing the right corporate credit card could be the financial lever that unlocks smarter spending, tighter controls, and better cash flow. Whether you're a founder managing early-stage expenses or a finance leader overseeing hundreds of monthly transactions, the right business credit card can help you reduce administrative overhead, earn rewards, and eliminate the chaos of reimbursements.

But with so many providers, from big banks to new fintechs, figuring out which card is best can feel overwhelming. This guide cuts through the noise to help you find the best corporate credit cards in Canada for your team’s size, spend habits, and financial goals.

We’ll walk you through the most important features, common pitfalls, card types, and corporate credit card programs built for Canadian businesses, so you can make the smartest, most compliant choice for your company. We'll also look at Venn's corporate card solution for Canadian businesses, what the benefits are, and how over 5500 Canadian businesses are using Venn to strengthen their finances.

What Is a Corporate Credit Card?

A corporate credit card (sometimes called a business card or commercial card) is a financial tool that allows employees to make purchases on behalf of the company, without using personal funds or waiting on reimbursements.

In Canada, there are generally two categories:

- Business Credit Cards – Geared toward small businesses or sole proprietors, often requiring a personal guarantee and credit check. The card holder is often held liable for balances if the business doesn’t have funds available.

- Corporate Credit Cards – Designed for established or scaling businesses with higher monthly spend, more users, and no personal guarantees.

Key Features of Corporate Cards:

- Issued in your company’s name, not tied to a founder's personal credit

- Higher spending limits and better visibility into team-wide transactions

- Real-time controls: set limits by team, category, or vendor

- Streamlined reconciliation with your accounting software

Unlike personal cards, these programs are built to scale with your business, whether you’re managing five employees or five hundred.

Types of Corporate Credit Cards in Canada

Choosing the right corporate credit card for your business starts with understanding the different card types available in Canada, and how they align with your team’s spending habits, use cases, and growth stage.

Each type of corporate card comes with its own perks, controls, and suitability. Here's a breakdown of the most common options:

1. Traditional Corporate Credit Cards

Best for: Mid-sized to large companies with established credit

These are the classic business cards offered by Canada’s major banks. They typically provide credit limits based on your business’s financials and offer reward programs, expense tracking, and employee card issuance. However, they often require longer approvals, annual fees, and may lack real-time controls.

Examples: RBC Avion Visa Infinite Business, Scotiabank Momentum for Business Visa

2. Corporate Charge Cards

Best for: Businesses with high or variable spend and strong cash flow

Unlike credit cards, charge cards require you to pay off the full balance every month. They usually offer higher spending limits, but without revolving credit. This can help businesses stay disciplined and avoid interest, while still benefiting from rewards and detailed reporting.

3. Prepaid Corporate Cards

Best for: Startups and budget-conscious teams

Prepaid corporate cards require funds to be loaded in advance. They offer excellent spend control and eliminate the risk of debt. These are great for businesses looking to manage employee spend with strict boundaries, especially for project-based or temporary staff.

4. Virtual Corporate Cards

Best for: Online transactions, subscriptions, and vendor payments

Issued instantly and used digitally, virtual corporate credit cards offer high security and flexibility. You can assign single-use or recurring cards to employees, departments, or vendors, with custom spend limits and expiration dates. Ideal for remote teams and decentralized spending.

5. Fleet Cards

Best for: Companies with vehicles and transportation expenses

Fleet cards are tailored for fuel, maintenance, and travel-related purchases. They offer per-vehicle tracking, fuel discounts, and category-specific controls to monitor vehicle-related expenses with ease.

6. Purchasing Cards (P-Cards)

Best for: Procurement teams and vendor-specific spend

P-Cards streamline vendor payments and eliminate the need for purchase orders. They simplify reconciliation, reduce paperwork, and keep procurement spend within budget.

7. T&E (Travel and Entertainment) Cards

Best for: Sales teams, executives, and frequent travelers

T&E cards are used for travel bookings, client dinners, and hospitality expenses. They often come with perks like travel insurance, lounge access, and hotel discounts, making them essential for teams on the move.

8. Expense Management Cards

Best for: Finance teams that need full visibility and automation into employee expense management

These modern cards come bundled with software that integrates directly with your accounting tools. Think of them as smart corporate cards, offering granular controls, automated approvals, and real-time reporting to cut down on manual reconciliation.

Corporate Credit Card Programs: How They Work

Corporate credit card programs are more than just a plastic card with your company’s name on it, they’re a spend management system built to streamline payments, enforce policy, and support scalable growth.

Whether you’re onboarding five employees or fifty, a good program should give you centralized control, real-time visibility, and seamless integrations with your financial tools.

How Corporate Card Programs Operate

Most corporate credit card programs in Canada follow a similar workflow:

- Card Issuance

You assign physical or virtual cards to employees or departments, each with custom rules: spend limits, categories, merchant restrictions, or project codes. - Transaction Capture

Employees use their cards for approved expenses (e.g., travel, subscriptions, vendor payments). Transactions appear instantly in the admin dashboard. - Policy Enforcement

Program rules kick in automatically, rejecting non-compliant purchases, flagging out-of-policy items, or requiring receipt uploads. - Reconciliation & Reporting

Integrated platforms sync with your accounting system (like Xero or QuickBooks), match receipts, and auto-categorize expenses, saving hours of manual work.

What Makes a Strong Corporate Card Program?

The best programs go beyond issuing cards, they offer automation, accountability, and audit-readiness out of the box.

Building a Corporate Credit Card Policy

A well-defined corporate credit card policy is essential for any business that wants to issue cards to employees without losing financial control. As Canadian startups and SMBs scale, they often struggle with spend visibility, inconsistent receipt capture, and ambiguous approval workflows. A clear policy solves this, not just for compliance, but for operational efficiency.

At its core, a corporate credit card policy is a set of rules and instructions that outlines how your company cards should be used, by whom, and under what conditions. It acts as both a safeguard and a permission structure, reducing the risk of misuse while empowering teams to spend within defined boundaries. This should be owned by the finance department or owner/founders at smaller businesses.

Learn more about the best corporate cards for startups in our blog here.

Why It Matters

Without a formal policy, your finance team may be forced into a reactive position, chasing down receipts, flagging unexpected charges, or scrambling to prepare for audits. Worse, your employees might hesitate to spend at all, delaying key purchases or vendor payments because they’re unsure what’s permitted.

With a solid corporate card policy in place, you eliminate ambiguity. Team members understand what’s acceptable (like software subscriptions or business travel), what’s not (like gift cards or alcohol), and how to stay compliant with tax rules and internal controls.

What to Include in Your Corporate Credit Card Policy

The best policies aren’t complicated, they’re just clear. Every corporate credit card policy should address these fundamentals:

- Eligibility: Which employees or departments are eligible for a card, and who approves issuance?

- Spending limits: Define transaction caps and monthly limits based on role, seniority, or department.

- Permitted expenses: Clearly list approved categories, such as SaaS tools, client meals, or travel, so there’s no confusion.

- Receipt submission rules: Outline how and when receipts must be submitted (ideally in real-time via mobile capture).

- Review and approval flow: Explain who’s responsible for reviewing card spend and how disputes or non-compliant charges are handled.

- Consequences of misuse: Set expectations for disciplinary steps if the policy is violated, even unintentionally.

While this might sound heavy, most of these fields are already built into the best corporate card programs (like Venn). You can automate approvals, enforce limits, and prompt employees for receipts in real time, turning your policy into something that works in the background without friction.

Operationalizing Your Policy

Writing a corporate credit card policy isn’t enough. You need to embed it directly into the tools your team uses daily. For example, leading Canadian platforms like Venn let you trigger policy reminders when employees go to spend, enforce category-based restrictions automatically, and require digital agreement before issuing a card.

This isn't just about more rules for the sake of it, it's about creating a culture of trust and accountability around business spending.

Top Benefits of Corporate Credit Cards for Businesses

The right corporate credit card doesn’t just help your team spend effectively, it gives your finance team the controls, visibility, and automation they need to scale confidently. For Canadian businesses managing distributed teams, global vendors, or high-volume transactions, the benefits go far beyond cashback or convenience.

Here’s how a well-structured corporate card program transforms business finance.

1. Streamlined Employee Spend

Issuing corporate credit cards to employees removes the friction of reimbursements. Team members can pay for what they need, software, travel, meals - without using personal funds. This improves operational speed and employee satisfaction, especially for fast-moving teams or remote staff.

2. Real-Time Controls & Visibility

Modern corporate credit cards give finance teams the ability to set limits by employee, merchant, or category in real time. You can instantly pause cards, restrict spend types, and view transactions as they happen, no more waiting for month-end surprises.

3. Automated Reconciliation

With the right platform, every transaction is automatically categorized, matched to a receipt, and synced to your general ledger. For businesses using tools like QuickBooks or Xero, this means faster month-end close and fewer manual errors.

4. Reduced Fraud & Policy Violations

Unlike traditional credit cards, corporate cards with built-in policy enforcement can prevent out-of-scope purchases before they happen. You can define exactly what’s allowed and get notified of exceptions, making audit prep significantly easier.

5. FX and Multi-Currency Efficiency

For Canadian businesses that operate cross-border, whether billing in USD, buying from US vendors, or paying international contractors, the best business credit cards in Canada now include multi-currency support. This reduces costly FX fees and enables seamless USD or EUR transactions without extra conversions.

6. Cashback and Rewards That Actually Work for Business

While many legacy cards offer points with fine print, some corporate cards offer flat-rate cashback on all eligible spend, no tiers, categories, or minimums. For growing businesses, this can generate meaningful returns that can be reinvested into operations.

Risks & How to Stay Compliant

Corporate credit cards can unlock huge operational value for Canadian businesses, but without the right structure, they can also open the door to financial risk, regulatory issues, and audit headaches. From unauthorized purchases to missing receipts, the risks are real. The can become especially problematic as your team scales both in size and complexity.

But the good news is: most risks can be mitigated through smart systems and policies built into your corporate card program.

Common Risks of Corporate Card Usage

- Unapproved Spend

Employees may unintentionally charge personal or out-of-scope items, especially without clear policy enforcement. This creates issues for budgeting, tax deductions, and financial reporting. - Lost Receipts & Poor Documentation

Without receipt capture tools, your month-end reconciliation process turns into a scavenger hunt. It also makes audits more painful and can increase exposure during CRA reviews. - Lack of Real-Time Oversight

Legacy card systems often have delayed transaction visibility, forcing finance teams to manage spend reactively. This delay increases the risk of fraud or duplicate charges. - Foreign Transaction Fees & FX Markups

Using a CAD-only card for USD expenses (e.g., for US vendors or subscriptions) can result in unexpected FX fees, often as high as 2.5% to 3% per transaction. - Employee Card Sharing

In businesses without card issuance controls, employees may share corporate cards informally, making it impossible to trace purchases or enforce limits at the individual level.

How to Stay Compliant (and In Control)

To stay compliant and audit-ready, your business needs more than just a policy, it needs a system that enforces it.

The best corporate credit card platforms in Canada now include:

- Built-in spend rules: Pre-define what’s allowed based on department, vendor, or amount.

- Real-time transaction monitoring: See every expense as it happens, no batch surprises.

- Instant receipt capture: Employees can upload a photo via mobile app, right at the point of spend.

- Multi-user controls: Assign individual cards with custom rules, no card sharing required.

- Accounting integrations: Push categorized transactions directly to your GL (e.g., Xero, QuickBooks).

How to Choose the Right Corporate Card in Canada

Selecting the right corporate credit card for your business is a financial decision with operational consequences. Whether you're a founder managing growth or a CFO standardizing spend policies across departments, the card you choose should align with your control needs, team size, and software stack.

With a growing number of Canadian providers offering corporate card programs, it is essential to compare not just the rewards or annual fees, but how each card handles compliance, integrations, and international transactions.

Business Model and Card Fit

The needs of a five-person startup are very different from those of a 100-person SaaS company. Choose a card designed for your stage. Smaller teams may prioritize simplicity and fast onboarding, while larger finance teams require approval flows, expense categorization, and real-time visibility.

Spend Control and Policy Enforcement

A modern corporate credit card should allow finance to set spend limits by employee, vendor, or category. Systems that support policy enforcement by default can reduce risk and eliminate the need for post-spend policing.

Multi-Currency Capabilities

Many Canadian businesses transact in USD, GBP, or EUR. Using a CAD-only card can result in foreign exchange markups and fees. Corporate cards with built-in multi-currency support allow your team to pay in the required currency without manual conversions or separate accounts.

Integration with Accounting Tools

Accounting integration is no longer optional. A card that connects directly with tools like QuickBooks, Xero, or NetSuite reduces reconciliation time and helps finance teams close books faster and with fewer errors. Manual CSV uploads are no longer acceptable at scale.

Rewards and Fee Structures

Evaluate whether the rewards structure fits your typical spend. Some cards offer cashback on all transactions, while others offer tiered points programs with restrictions. For most operational finance teams, predictable cashback provides more value than complex point systems.

Approval Process and Onboarding

Look for providers that offer digital onboarding, no personal guarantee requirements, and the ability to issue cards quickly. Delays in approval or manual paperwork slow down team productivity and increase reliance on shared or personal cards.

Visibility and Real-Time Data

A good corporate credit card platform provides instant transaction visibility. This improves reporting accuracy, ensures faster approvals, and allows finance to take action if a transaction appears out of policy.

Key Takeaway: Why Venn is the Right Choice

For Canadian businesses looking for a purpose-built solution, Venn offers the most complete corporate credit card experience available. With real-time controls, multi-currency support (CAD, USD, GBP, EUR), accounting integrations, and automated policy enforcement, Venn is designed for finance teams that need to scale with confidence. It eliminates the legacy trade-offs of traditional providers and replaces them with infrastructure that supports modern operational finance.

Important Note: While this guide uses “corporate credit card” for clarity and search relevance, Venn offers a corporate charge card. This means there is no revolving credit or interest; instead, balances are due in full and limits are set based on business health, offering control without debt exposure.

Corporate Credit Card Comparison for Canadian Businesses

With multiple corporate credit card providers in Canada, it can be difficult to determine which card best fits your operational needs. While legacy financial institutions offer familiarity, modern platforms prioritize real-time controls, better integrations, and global flexibility.

The table below compares top options available to Canadian businesses across key features like fees, rewards, controls, and software integrations.

Final Thoughts and Getting Started

Corporate credit cards have become essential tools for modern Canadian businesses. Whether you're managing employee expenses, scaling vendor payments, or simply trying to bring order to month-end close, the right card program can reduce administrative overhead, improve compliance, and give finance teams the real-time control they need.

But not all cards are built for operational finance. Traditional options often lack the automation, policy enforcement, and international flexibility required by growing companies. As this guide shows, businesses need more than just a payment method, they need a system that integrates with their workflows and supports scale.

For Canadian startups, SaaS companies, and SMBs, Venn offers the most complete corporate card solution on the market. With zero annual fees, 1% cashback, multi-currency capabilities, and native accounting integrations, Venn helps finance teams stay lean, compliant, and in control.

If your current card can’t do all of the above, it may be time to upgrade.

Explore what Venn can do for your business.

While this article compares corporate credit cards across multiple providers, it’s worth noting that Venn’s product is a corporate charge card. It delivers the same control, automation, and spend infrastructure finance teams expect, without revolving debt or interest-bearing balances.

Frequently Asked Questions:

Q: What is a corporate credit card and how is it different from a business credit card?

A: Corporate credit cards are issued to companies rather than individuals, usually with centralized billing and stronger expense management controls. Business credit cards are often personally guaranteed and tied to the business owner.

Q: Do corporate credit cards in Canada require a personal guarantee?

A: Many traditional banks do, but modern fintech providers increasingly offer corporate cards with no personal guarantee for companies that meet revenue and financial stability requirements.

Q: Can I issue employee cards and set spending controls?

A: Yes. Most corporate card platforms allow issuing employee cards with spending limits, merchant restrictions, category rules, and real-time visibility.

Q: How expensive are FX fees on Canadian corporate credit cards?

A: Traditional cards typically charge 2.5–3% FX markup. Modern fintech and multi-currency cards reduce FX to ~0.25–0.6% or eliminate it by spending directly from USD or other currency balances.

Q: Do corporate cards integrate with QuickBooks and Xero?

A: Many do. Modern platforms support two-way sync, automated categorization, and receipt capture, significantly reducing manual reconciliation compared to traditional bank cards.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Venn Software Inc or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.