Best Credit Card for Canadian Startups in 2026

Discover the cheapest way to send business transfers in Canada. Compare fees, FX rates, and payment options to save money and boost your bottom line.

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

Why Startups in Canada Have Unique Spending Needs

Canadian startups operate under a unique set of financial pressures: cross-border complexities, lean teams, unpredictable cash flow, and funding cycles that don’t always match operational demands. That’s why choosing the right business corporate card isn’t just about perks, it’s about scalability, visibility, and control.

Cash Flow Volatility and Seasonal Spikes

Startups rarely have predictable cash flow. Whether you're an early-stage SaaS business waiting on your next funding round or a growing ecommerce brand navigating seasonal spikes, flexibility in spend is critical. A corporate card that offers real-time expense visibility and automated controls helps finance teams stay on top of spend even when revenue is lumpy.

Cross-Border Spending and FX Costs

Many Canadian startups operate in multi-currency environment, paying US-based vendors, remote contractors, or international SaaS platforms. Traditional cards often layer in foreign transaction fees, poor FX rates, or limited multi-currency support. For startups expanding globally, that can quietly erode margins. Look for a solution that offers local currency accounts and low FX fees to maintain efficiency.

Time-Starved Finance Leaders

Startup finance teams are typically small. Controllers, fractional CFOs, or founders themselves often juggle bookkeeping, budgeting, and burn-rate forecasting. Without automation, managing corporate spend becomes a manual, error-prone process. That’s why best-in-class corporate cards for Canadian startups should offer direct integrations with QuickBooks and Xero, automated reconciliation, and approval workflows to reduce time spent chasing receipts.

Funding Constraints and Underwriting Barriers

Most traditional providers underwrite based on credit history or time in business, two things startups often lack. This forces founders to either rely on personal guarantees or settle for basic prepaid cards with limited controls. The best business corporate cards for startups offer flexible underwriting based on revenue or cash flow, removing the need to risk personal credit.

Risk and Control

Without real-time controls or spending limits, founders risk fraud, employee misuse, or even just good old-fashioned overspending. A modern Canadian corporate card should offer virtual cards, per-transaction limits, and category-level controls to mitigate these risks proactively.

What Is a Business Corporate Card?

A business corporate card is a financial tool designed to streamline and track company expenses, from software subscriptions to team travel. Unlike personal cards or basic prepaid solutions, the best corporate cards for Canadian startups offer centralized visibility, real-time controls, and native integrations with your accounting tools.

More Than a Payment Method

For early-stage companies, a business corporate card should act like an extension of your finance stack, not just a way to pay for things. The right solution supports:

- Real-time expense tracking

- Automated approval workflows

- Spending limits and category-level controls

- Multi-user access without shared cards

- Direct integration with Xero and QuickBooks

This makes it easier for founders, CFOs, and finance leads to maintain oversight without adding manual overhead.

Why It’s Different from a Personal or Prepaid Card

Most founders start by using their personal credit cards. But personal cards create messy reconciliations, carry personal liability, and don’t scale with team growth. Prepaid cards solve some of these issues, but often lack features like automated spend control, employee card programs, or real-time syncing with accounting software.

A business-focused corporate card is purpose-built to grow with your team. It enables:

- Virtual card issuance for different vendors or employees

- Custom spend policies per team, project, or individual

- Audit trails that simplify month-end close and reduce compliance risk

Pro tip: Look for providers that offer both physical and virtual card options, virtual credit cards are ideal for recurring SaaS, marketing tools, and one-time online purchases where fraud risk is higher.

Why Virtual Cards Matter

For startups, virtual cards aren’t a nice-to-have, they’re essential. They enable:

- Faster onboarding for new hires

- Tighter control of vendor charges

- Fraud mitigation with single-use or vendor-specific cards

If your current provider doesn’t offer unlimited virtual cards, or makes you pay extra for issuing more, you’re likely using a solution not built for modern teams.

Why a Corporate Card Is Critical for Startup Success

For Canadian startups, choosing the right corporate card isn’t just a financial decision, it’s a foundational move that sets the tone for how you operate, scale, and stay in control. From fundraising rounds to first hires, the right card simplifies spending while protecting your runway.

Smooths Out Cash Flow Gaps

Startups often deal with inconsistent revenue and delayed receivables. A corporate card gives you the breathing room to cover expenses during tight months, letting you defer payments by a billing cycle or more. Paired with a low FX solution and smart cash flow controls, this can dramatically reduce financial stress.

Unlocks Financial Visibility Early

Real-time visibility into spending is a game-changer, especially when your finance team consists of one person (or you’re still doing the books yourself). A modern corporate card helps you manage all your employees spend, all in one dashboard.

Enables Smarter Scaling

The best business credit cards for startups support growth without requiring a complete overhaul. With Venn, for example, you can:

- Issue unlimited virtual credit cards instantly

- Set custom limits by team or role

- Sync spend directly with QuickBooks or Xero for automated reconciliation

That means no more spreadsheet chaos or month-end surprises.

Builds Credit and Lowers Risk

Many Canadian founders unknowingly tie their personal credit to the business by using personal cards. A true corporate card, especially one with no personal guarantee, helps you establish business credit independently, while reducing liability and simplifying accounting.

Streamlines Operations Across the Board

A corporate card that plugs into your financial stack (think: accounting, bill pay, payroll, and vendor payments) can save dozens of hours per month. And with features like pre-authorized debits, instant card issuance, and in-account FX, you're removing friction from every corner of your ops.

“As we scaled, we didn’t just need just a card, we needed infrastructure. Having spend controls, instant card creation, and low FX built in gave us a financial edge without adding more headcount.”

— Finance lead, Series A SaaS startup

What to Look For in a Startup Corporate Card

Not all business credit cards are built with startups in mind. Founders need more than cashback perks, they need flexibility, visibility, and infrastructure that supports growth from day one. Here’s what to prioritize:

1. No Personal Guarantee Required

Choose a card that separates your personal and business finances. Cards without a personal guarantee protect founders from being personally liable for business debt, critical in the early stages of growth.

2. Unlimited Virtual Cards

Virtual cards let you assign spend by vendor, department, or employee. They offer enhanced security, easy control, and are essential for remote or fast-moving teams.

3. Real-Time Spend Controls

Look for dynamic spend controls that go beyond basic limits. That includes daily and category-specific rules, custom approval workflows, and the ability to freeze cards instantly.

4. Direct Accounting Integrations

Manual entry is a time sink. A strong startup card should plug into your accounting software to automate reconciliation, sync receipts, and reduce month-end stress.

5. Multi-Currency and FX Efficiency

If you pay international vendors or receive foreign income, having one card that works across CAD, USD, GBP, and EUR, with built-in FX optimization, can reduce fees and streamline operations.

6. Built for Canadian Operations

Startups in Canada face unique requirements, from paying GST/HST to handling Interac transfers. Ensure your card provider supports domestic payment rails and can integrate into the broader Canadian financial ecosystem.

Best Business Credit Cards for Startups in Canada

Venn

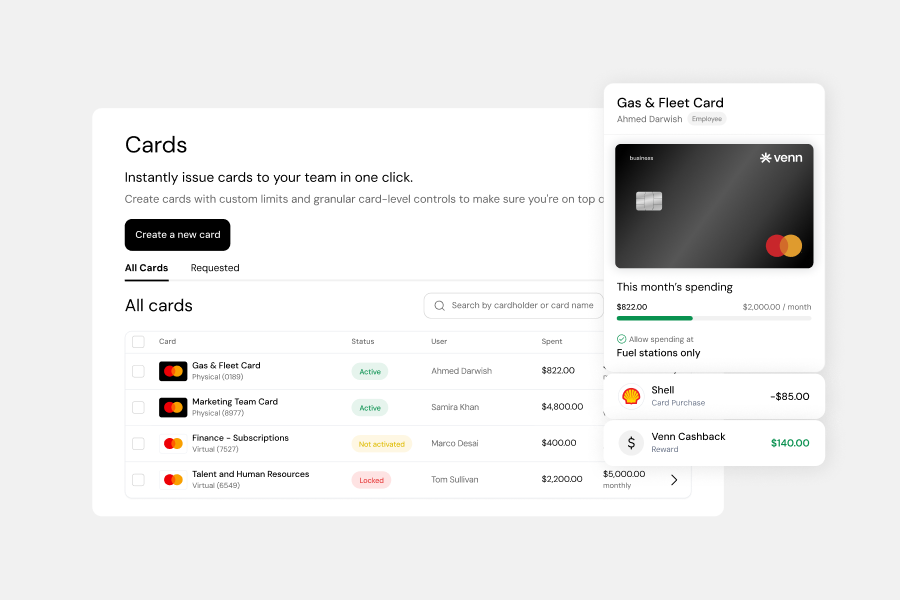

For Canadian startups that operate across borders or rely heavily on software subscriptions, Venn stands out as a purpose-built financial platform that combines a multi-currency business account with a powerful corporate card. Unlike many traditional options, Venn provides actual USD, CAD, GBP, and EUR accounts under one roof, giving SaaS startups and e-commerce businesses the ability to pay vendors and receive funds without expensive currency conversion or SWIFT fees. The other unique thing regarding Venn's corporate cards is that they're multi currency. Meaning that you only need to have 1 card to spend across CAD/USD/EUR/GBP without paying fx fees on conversions.

What makes Venn particularly startup-friendly is its ability to issue unlimited virtual cards with custom spending limits and approval workflows. Founders can instantly create vendor-specific or employee-specific cards to better control spend across teams. As we mentioned prior, the card itself automatically detects and uses the right currency, a major advantage for Canadian businesses transacting frequently with U.S. or UK-based partners.

With 1% cashback on all purchases, no minimum spend thresholds, and no cap on rewards, Venn delivers tangible returns for high-growth startups scaling their ad spend or software tooling. There’s also no personal guarantee required in many cases, a relief for founders who want to separate personal liability from business financing. Overall, Venn positions itself as a financial operations platform, not just a card issuer, ideal for Canadian companies that want modern tools and global functionality from day one.

Float

Another solid option is Float, a Toronto-based fintech offering Canadian businesses access to corporate cards with integrated expense management. Float allows startups to issue both physical and virtual cards to employees while setting granular spending rules and automated approval flows. Its platform integrates with popular accounting tools like QuickBooks and Xero, which makes reconciliation and month-end close easier.

Float doesn’t require a personal guarantee for many startups, and it provides a simple cashback rewards structure that requires a minimum of $25,000 spend a month to qualify for their cashback. It's currency options are more limited compared to Venn, and FX fees may apply for U.S. or international spend, however it remains a compelling entry point for small teams that need basic spend visibility and scalable controls. Startups that don’t yet need full multi-currency infrastructure and are spending at least $25,000 will find Float to be a reliable partner.

RBC Business Cash Back Mastercard

For startups that prefer to work with a traditional financial institution, the RBC Business Cash Back Mastercard offers a straightforward value proposition. It charges no annual fee and provides 1% cashback on eligible purchases, along with standard protections like purchase insurance and extended warranties. RBC’s card can be a good fit for sole proprietors or small teams just beginning to formalize their financial operations.

However, this card lacks the automation, virtual card issuance, and real-time controls that many startups now expect. Companies looking to scale, or those with multiple employees spending across categories, may find RBC’s offering limiting. There’s also less flexibility when it comes to handling U.S. transactions or integrating with modern accounting platforms.

Scotiabank Scotia Momentum® for Business Visa

For startups with steady monthly expenses on gas, office supplies, or meals, Scotiabank’s Scotia Momentum® Business Visa offers up to 3% cashback in select categories. It’s a fit for founders who want predictable returns on regular business purchases especially those running delivery-based or field-service businesses. While the $79 annual fee is reasonable, early-stage companies with variable spend or limited operating history may struggle to get approved.

The key limitation here is that Scotiabank offers no built-in spend management tools. Startups must track spending manually or integrate with third-party expense software. There's also no virtual card functionality, which makes scaling team-level purchasing cumbersome. It's a viable legacy-bank option, but less suited for digital-first companies prioritizing agility.

TD Business Cash Back Visa

The TD Business Cash Back Visa offers simplicity and stability, with 2% cashback on recurring bills, office supplies, and gas, all without an annual fee. This card is attractive for startups with lean teams and low operational complexity, or those just beginning to separate business and personal spending.

However, TD’s interface lacks the real-time tracking and approval layers that modern startups often need. Founders still have to manually manage cardholders, reconcile receipts, and handle reimbursements without the help of automation or virtual card infrastructure. This option is best suited for businesses that value name-brand familiarity and aren’t yet scaling spend across departments.

American Express® Business Gold Rewards Card

For startups that spend significantly on advertising, travel, or software, the Amex Business Gold Rewards Card can be a powerful tool. With its points-based rewards system and access to premium services, this card appeals to scale-ups with complex spend profiles and high monthly transaction volumes.

Still, there are trade-offs: a $199 annual fee, a relatively steep underwriting process, and a lack of native real-time controls or multi-card visibility. While Amex does offer some expense reporting functionality, it’s not built for fast-scaling teams that want dynamic card issuance, granular controls, or full accounting automation. Startups using Amex should be prepared to supplement with third-party integrations or finance ops platforms.

CIBC bizline® Visa Card

The CIBC bizline® Visa Card functions more like a line of credit than a traditional corporate card. It offers low interest rates and no annual fee — making it a good choice for cash-conscious startups needing emergency liquidity or occasional financing flexibility.

That said, this card provides almost no modern features: no rewards, no virtual cards, no spend controls, and no software integrations. It’s most appropriate for businesses in stabilization mode or those simply looking to build a credit history. Startups that rely on digital tools, real-time oversight, or decentralized spending will likely outgrow this option quickly.

BMO AIR MILES® No-Fee Business Mastercard®

For founders already entrenched in the AIR MILES ecosystem, BMO’s No-Fee Business Mastercard allows you to earn miles on every $20 spent, without any annual fee. It includes standard protections and is designed for simple, centralized business purchases.

However, miles can be less flexible than cashback for most startups, and this card doesn’t support multiple cardholders, spending controls, or digital integrations. It's a minimalist option best suited for sole proprietors or legacy businesses, not SaaS or growth-stage startups managing multiple spend types.

Virtual Cards in Canada – What Startups Need to Know

Virtual credit cards are no longer a novelty, they're a financial necessity for modern startups managing dynamic spend across software, remote teams, and recurring subscriptions. But many Canadian founders still don’t realize just how powerful virtual cards can be for scaling smarter.

A virtual business credit card functions just like a physical card, but it exists only in digital form. These cards are ideal for online payments, vendor-specific charges, and teams that need secure, controlled access to funds without the risk of physical card misuse.

Why virtual cards matter for Canadian startups

Startups often juggle unpredictable expenses. Virtual cards let you:

- Instantly issue cards to employees, freelancers, or departments.

- Set spend limits by vendor, category, or project.

- Cancel or pause cards with a click, no need to wait for plastic replacements.

- Protect against fraud by creating single-use or vendor-locked cards.

They’re especially useful for SaaS-heavy startups who need to manage multiple subscriptions across tools like HubSpot, Notion, or AWS. Instead of losing visibility into who’s spending what, virtual cards provide granular tracking and accountability.

Where Canadian startups get stuck

Not every provider in Canada offers virtual cards, many traditional issuers still require physical cards, and few include native controls or integrations. U.S.-based fintechs may offer virtual options but lack Canadian compliance or local support.

The Venn advantage

Venn’s virtual corporate card program is purpose-built for Canadian startups. You can issue unlimited virtual cards with smart controls, enforce policy-level approvals, and integrate spend directly into your accounting software. Plus, Venn’s infrastructure supports both CAD and multi-currency setups, something most competitors miss.

Virtual cards aren’t just a convenience, they’re a foundational tool for scaling your finance function securely and efficiently.

Frequently Asked Questions About Business Credit Cards for Startups in Canada

Q: What is the best business credit card for startups in Canada?

The best option for startups is typically a corporate charge card that offers no personal guarantee and provides the tools for scaling. Venn is a top choice because it offers 1% unlimited cashback on all purchases, integrated multi-currency accounts, unlimited virtual cards, and seamless integration with accounting software like QuickBooks and Xero, all without tying the card to the founder's personal credit.

Q: Can I get a business credit card in Canada without a personal credit check?

Yes. Modern fintech providers (like Venn and Float) offer corporate cards without requiring a personal credit check or personal guarantee. These solutions assess the business's financial health, such as cash flow and operating balance, making them highly accessible to new businesses, early-stage startups, and sole proprietors.

Q: How do I qualify for a business credit card as a startup in Canada?

Qualifying for a modern corporate card is simpler than traditional bank cards. You primarily need a registered business (Articles of Incorporation or Master Business Licence) and a business bank account for verification. Traditional banks often require strong personal credit or several years in business, whereas fintechs focus on verifying the business's identity and cash position.

Q: Do business credit cards in Canada earn cashback?

Yes. Many Canadian business cards offer cashback, but the rewards are often capped or tiered by category. Venn stands out by offering a flat 1% cashback on all eligible business expenses with no cap or minimum spend threshold, allowing startups to maximize returns on large expenses like digital advertising and SaaS subscriptions.

Q: Are virtual business credit cards available in Canada?

Yes, virtual business credit cards are readily available in Canada, primarily through fintech platforms. Providers like Venn offer unlimited virtual cards that can be instantly issued, customized by vendor or department, and controlled with real-time spend limits—making them ideal for remote teams and managing recurring online subscriptions.

The comparative information provided on this page is based on publicly available sources and is accurate to the best of our knowledge as of September 20, 2025. Features, pricing, and terms may change without notice. For the latest information, please consult each provider’s official website directly. All trademarks and product names are the property of their respective owners. Their use does not imply any affiliation with or endorsement by those brands.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.