Amex Platinum Global Dollar Card Alternatives for Canadians in 2026

Explore top Amex Platinum Global Dollar Card alternatives for Canadians. Compare multi-currency features, FX rates, and rewards to optimize your business banking.

.png)

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

Canadian businesses seeking alternatives to the Amex Platinum Global Dollar Card face a critical decision that extends beyond simply finding a replacement card. With Amex cancelling the Platinum Global Dollar Card in early 2026, Canadian businesses will need to look for a replacement that not only checks the same boxes as the Amex card, but actually provides more value. This comprehensive guide examines the top alternatives available to Canadian businesses, comparing features, costs, and operational benefits.

You'll discover not just card replacements, but complete financial platforms that address multi-currency operations, expense management, and accounting integration. We'll provide detailed comparisons, cost calculations, and a practical transition plan to help you move from Amex Platinum to a solution that better serves your business's evolving needs.

Why Canadian Businesses Are Suddenly Searching for Amex Platinum Alternatives

For years, the Amex Platinum Global Dollar Card filled a unique gap for Canadian businesses that needed premium travel perks while billing in USD. It gave companies a Canadian-issued card with USD functionality, something no other premium card in Canada really offered.

Now that Amex is discontinuing the Global Dollar Card entirely, with the program ending on January 21, 2026, businesses are being forced to reassess their entire card setup rather than simply weigh a benefit change. Once the program shuts down, there is no equivalent Amex replacement.

USD spending becomes more complex overnight

Businesses that relied on Amex for USD billing now face two options:

- pay 2.5–3% FX markups on every USD transaction using a CAD card, or

- juggle the operational burden of a US-issued card with foreign banking requirements.

Neither option is efficient for companies handling regular US vendor payments, software subscriptions, travel, or client expenses.

Loss of built-in travel protections and premium perks

The Global Dollar Card wasn’t just about USD billing, it bundled in strong travel insurance, lounge access, and protective coverages frequently used by sales, executive, and operations teams. Once the card disappears, those protections disappear with it, leaving companies to rebuild their travel policy from scratch.

Points strategy disruption

Many companies maximized Amex Membership Rewards through travel redemptions or point transfers. With the card being discontinued, businesses now need to decide whether a points ecosystem still fits their needs or whether predictable cashback offers better value going forward.

Operational friction and forced workflow changes

A card shutdown creates significant administrative work: updating hundreds of vendor cards on file, pulling old statements, migrating travel profiles, clearing pending charges, and reissuing corporate cards. For finance teams already stretched thin, the forced transition adds real operational cost.

The bigger issue: no true multi-currency replacement from Amex

Even before the discontinuation, Amex didn’t offer a fully integrated USD banking environment, just a USD-billed card. Businesses earning USD through Stripe, Shopify, or US clients still had to convert funds or maintain separate accounts elsewhere.

Now, with the Global Dollar Card gone, Canadian businesses lose the only bridge Amex provided for multi-currency operations

What to Look for in an Amex Platinum Alternative

Evaluating alternatives requires looking beyond traditional card features to assess how solutions address your complete financial operations. The best alternative for your business depends on specific needs rather than generic premium perks.

Key criteria to evaluate when selecting an alternative:

• True multi-currency accounts that eliminate conversion between CAD, USD, EUR, and GBP

• Transparent FX rates with total cost clarity, not just "no fee" marketing claims

• Integrated expense management with OCR receipt capture and accounting sync

• Real-time spend controls for managing team expenses and budgets

• Cashback or rewards programs without complex redemption or high spending thresholds

• Travel benefits matched to actual usage patterns and frequency

• Total cost of ownership including fees, FX markups, and administrative time savings

Top Amex Platinum Global Dollar Card Alternatives for Canadian Businesses

The following alternatives offer superior value for Canadian businesses managing USD spending, cross-border operations, and team expenses. Each solution addresses different aspects of modern business financial management.

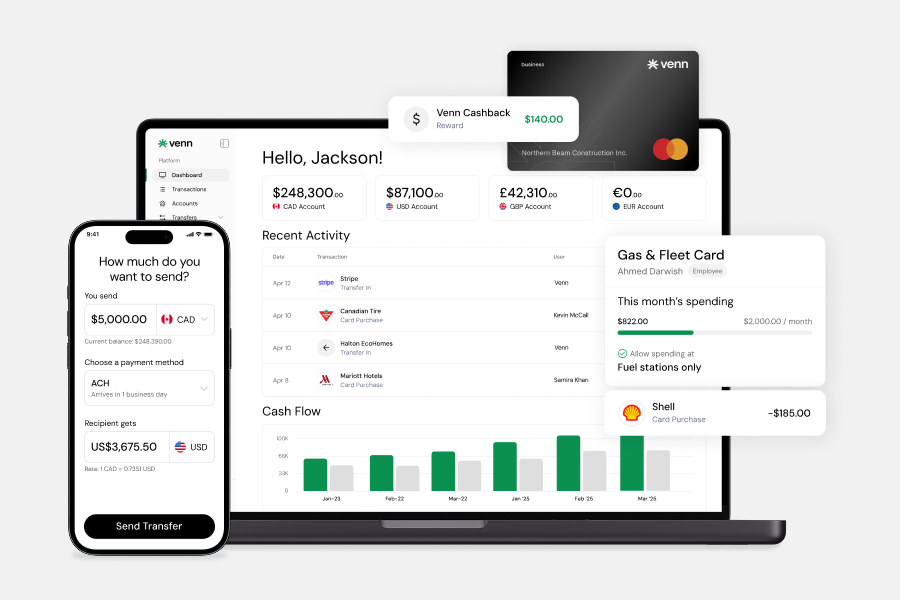

1. Venn Multi-Currency Business Platform

Best for: Canadian businesses seeking an all-in-one financial platform with real USD accounts, lowest FX rates, and integrated expense management.

Venn fundamentally reimagines business financial operations by combining real local accounts in four currencies with a multi-currency card that automatically charges in the currency you're spending. Unlike traditional cards that convert every transaction, Venn eliminates FX fees entirely when you hold funds in the currency of purchase. If you're paying a US vendor from your USD account, there's zero conversion.

The platform delivers the lowest FX rates in Canada at 0.25%-0.45%, compared to 2.5-3% charged by traditional banks. Combined with 1% unlimited cashback on all spending with no minimums, businesses see immediate cost savings. The integration with QuickBooks and Xero provides two-way sync, while built-in expense management with OCR receipt capture eliminates manual reconciliation.

Key Features:

• Real local accounts in CAD, USD, EUR, GBP

• 0.25%-0.45% FX rates (lowest in Canada)

• 1% unlimited cashback, no minimum spend

• Multi-currency card with automatic currency matching

• Free unlimited Interac e-Transfer®

• Two-way QuickBooks and Xero sync

• OCR receipt capture and invoice matching

• $0 monthly fee on Essentials plan

• 2% interest on CAD/USD balances

• Send/receive ACH, EFT, SEPA, Faster Payments

Who it's for: SMBs and startups with USD revenue or expenses, e-commerce businesses, companies with international suppliers, teams seeking to consolidate banking and expense management.

2. Scotiabank Passport Visa Infinite Business Card

Best for: Businesses seeking a traditional bank card with no foreign transaction fees and travel rewards.

Scotiabank's Passport Visa Infinite Business Card eliminates foreign transaction fees, applying only Visa's exchange rate to international purchases. While this saves the typical 2.5% FX fee, businesses still face exchange rate markups compared to platforms offering real multi-currency accounts. The card earns 1.5 Scene+ points per dollar spent, redeemable for travel, merchandise, or statement credits.

Travel benefits include six complimentary airport lounge visits annually through Priority Pass, comprehensive travel insurance, and Avis Preferred Plus membership. The $199 annual fee positions it as a mid-tier option between basic business cards and premium offerings like Amex Platinum.

Key Features:

• $199 annual fee

• 1.5 Scene+ points per $1 spent

• No foreign transaction fees

• Six airport lounge visits per year

• Travel insurance coverage

• Avis Preferred Plus membership

• Welcome bonus: up to 40,000 Scene+ points

• Visa mid-market exchange rate

Who it's for: Businesses with established banking relationships at Scotiabank, moderate international spending, preference for points-based rewards.

3. RBC Avion Visa Infinite Business Card

Best for: Businesses prioritizing flexible travel rewards and comprehensive insurance.

RBC's Avion Visa Infinite Business Card offers flexibility through its transferable points program, allowing conversions to multiple airline partners including WestJet, British Airways, and Cathay Pacific. The card earns 1.25 points per dollar on all purchases, with points valued at approximately 2 cents each when transferred to airline programs.

The comprehensive insurance package includes travel medical, trip cancellation, rental car coverage, and purchase protection. However, the card charges standard 2.5% foreign transaction fees, making it less suitable for businesses with significant international spending.

Key Features:

• $120 annual fee

• 1.25 points per $1 spent

• Transferable points to airline partners

• Travel insurance suite

• Foreign transaction fees apply (2.5%)

• Welcome bonus available

• Purchase protection and extended warranty

Who it's for: Businesses with existing RBC relationships, frequent business travelers who value airline partnerships, teams seeking comprehensive insurance coverage.

4. BMO Ascend World Elite Business Mastercard

Best for: Businesses seeking premium travel benefits with a lower annual fee than Amex Platinum.

BMO's Ascend World Elite Business Mastercard provides a middle ground for businesses wanting some premium benefits without the high cost of top-tier cards. The card includes four Priority Pass lounge visits annually and earns accelerated rewards on travel and dining purchases at 1.5 points per dollar.

While the $150 annual fee is reasonable, the card applies standard 2.5% foreign transaction fees. The BMO Rewards program offers flexibility but generally provides lower redemption value compared to cashback or transferable points programs.

Key Features:

• $150 annual fee

• 1.5 points per $1 on travel and dining

• 1 point per $1 on other purchases

• Four Priority Pass lounge visits annually

• Travel insurance included

• Foreign transaction fees apply (2.5%)

• Welcome bonus available

Who it's for: Businesses seeking moderate premium benefits at a lower price point, BMO banking customers, teams with occasional travel needs.

Side-by-Side Comparison: How These Alternatives Stack Up

Here's how the top alternatives compare across the features that matter most for Canadian businesses.

How to Choose the Right Alternative for Your Business

The best alternative depends on your specific business needs, spending patterns, and operational requirements. Making the right choice requires analyzing your actual usage patterns rather than being swayed by premium perks that may not deliver value.

Calculate your true FX costs. If you spend $50,000 annually in USD, a 2.5% FX fee costs you $1,250. Platforms with real USD accounts like Venn eliminate this entirely, while "no FX fee" cards still apply exchange rate markups.

Consider total cost of ownership. Annual fees are just one piece. Factor in FX costs, time spent on expense reconciliation, and integration with your existing tools.

Evaluate multi-currency needs. If you have USD revenue from Stripe, Shopify, or PayPal, or pay international suppliers, real multi-currency accounts save significantly more than cards alone.

Assess your accounting workflow. Modern platforms with two-way sync save 8+ hours monthly on reconciliation. Traditional cards require manual exports and matching.

Match rewards to actual spending. 1% cashback with no minimums beats 1.5% points that require high thresholds or complex redemption.

Think beyond the card. Businesses seeking operational efficiency benefit most from platforms that combine banking, cards, and expense management in one place.

Why Venn Is the Best Alternative for Canadian Businesses

While traditional business credit cards solve one problem (payment method), Venn addresses the complete financial operations challenge that modern Canadian businesses face. It's not just an alternative to the Amex Platinum Global Dollar Card, it's a fundamental upgrade to how businesses manage multi-currency operations.

What sets Venn apart is the combination of real local accounts in four currencies (CAD, USD, EUR, GBP), the lowest FX rates in Canada (0.25%-0.45%), and a multi-currency card that automatically charges in the currency you're spending. This means if you're paying a US vendor, the card draws from your USD account with zero conversion. No other business card in Canada offers this functionality.

Beyond superior FX economics, Venn consolidates what typically requires 3-4 separate tools: business banking, corporate cards, expense management, and accounting integration. You get 1% unlimited cashback with no spend minimums, OCR receipt capture, invoice matching, and two-way sync with QuickBooks and Xero. For businesses with USD revenue from Stripe, Shopify, or PayPal, Venn eliminates the 1.5% cross-border fee by providing real USD accounts. The platform also enables functionality traditional banks don't offer SMBs, including sending EFTs domestically and receiving ACH payments from US customers.

Your Step-by-Step Transition Plan

Switching from Amex Platinum to a modern alternative requires planning, but the process is straightforward with the right approach.

Step 1: Audit Your Current Setup (1 week)

• List all recurring subscriptions and payments on your Amex

• Document which vendors accept alternative payment methods

• Calculate your actual FX costs from the past 12 months

• Review your accounting workflow and time spent on reconciliation

Step 2: Open Your New Account (1-3 days)

• Apply for your chosen alternative (Venn accounts open in minutes)

• Fund your account and request physical/virtual cards

• Set up accounting software integration

• Configure spend controls and approval workflows

Step 3: Update Payment Methods (2 weeks)

• Start with new subscriptions and purchases on your new card

• Gradually update recurring payments to avoid service interruptions

• Keep your Amex active during the transition period

• Update payment details with key vendors and platforms

Step 4: Complete the Migration (1-2 weeks)

• Move final recurring payments to your new platform

• Download final statements from Amex for records

• Cancel your Amex or downgrade to a no-fee option

• Train your team on new expense submission workflows

Pro tip: Businesses using Venn can complete this transition faster because the platform's multi-currency accounts and integrated expense management eliminate the need to coordinate across multiple tools.

Conclusion

The search for Amex Platinum Global Dollar Card alternatives reveals a broader opportunity for Canadian businesses. Traditional premium cards were built for individual travelers, not modern business operations. The alternatives that deliver the most value combine multi-currency capabilities, transparent pricing, and integrated financial operations in a single platform.

For Canadian businesses managing USD spending, paying international suppliers, or receiving cross-border revenue, Venn offers the most comprehensive solution. With real local accounts in four currencies, the lowest FX rates in Canada, 1% unlimited cashback, and built-in expense management, it's not just an alternative to Amex Platinum, it's a complete upgrade. Sign up for your Venn account and start saving on every international transaction.

Frequently Asked Questions

Q: What happened to the Amex Platinum Global Dollar Card in Canada?

A: While the Amex Platinum Card remains available in Canada, recent changes including 2027 lounge access restrictions (requiring $20,000 annual spend for unlimited access) and high annual fees ($799) have prompted many Canadian businesses to seek alternatives with better multi-currency functionality and lower total costs.

Q: What's the difference between "no foreign transaction fee" and true multi-currency accounts?

A: "No foreign transaction fee" cards still convert currencies at the card network’s exchange rate, which includes a 2–3% markup. True multi-currency accounts (like Venn’s) let you hold and spend in USD, EUR, or GBP directly, eliminating conversion costs entirely when you have funds in the currency you're spending.

Q: Can I get a USD business credit card in Canada?

A: Most Canadian banks offer CAD-based cards that only simulate USD spending and still charge FX fees. Platforms like Venn and Float offer true USD cards connected to real USD accounts. Venn provides local US banking details that can send and receive ACH transfers—something even most US banks do not offer to Canadian businesses.

Q: How much can I save by switching from Amex Platinum to a multi-currency platform?

A: Businesses spending $50,000 annually in USD save $1,250+ on FX fees alone. When adding the difference in annual fees ($799 vs $0 for Venn Essentials) plus 1% cashback on all spending, total savings often exceed $3,000–$5,000 annually for mid-sized businesses.

Q: What's the best alternative for businesses with employees who travel frequently?

A: For heavy travel needs, Scotiabank Passport Visa Infinite Business (6 lounge visits, no FX fees) or BMO Ascend (4 visits) are strong options. Many businesses pair this with Venn for multi-currency savings, 1% cashback, and better expense management, often outperforming premium travel cards on total annual

---

**Disclaimer:** This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Venn Software Inc or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.