Amex Platinum Business Card Alternatives for Canadians in 2026

Explore top Amex Platinum Business Card alternatives for Canadians. Compare fees, rewards, FX rates, and modern features to find the best fit for your business.

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

The American Express Platinum Business Card has long been the status symbol of Canadian business credit cards. But at $799 per year, with lounge access restrictions coming in 2027 and lacking modern financial features, many Canadian businesses are reconsidering whether it still delivers value.

Today's alternatives offer more than just lower fees. Modern business finance platforms provide multi-currency accounts, automated accounting, and foreign exchange rates that traditional cards can't match. Whether you need a simple cashback card or a complete financial operating system, the Canadian market now offers compelling options beyond Amex Platinum.

This guide examines the best alternatives available to Canadian businesses, from traditional bank cards to fintech platforms. We'll compare real costs, features that matter, and help you choose based on your actual business needs, not marketing promises.

Why Canadian Businesses Are Looking for Amex Platinum Alternatives

The $750 annual fee represents just the beginning of Amex Platinum's true cost. When businesses calculate the total expense including foreign exchange markups, opportunity costs of complex rewards programs, and time spent on manual expense reconciliation, the premium becomes harder to justify. There are also rumours that many GDC programs will come to an end in 2026 for Canadians, so preparing your business for an alternative has become top of mind for many Canadians.

American Express announced significant changes to their lounge access program starting in 2027. Platinum cardholders will face new restrictions on visit frequency and guest access, diminishing one of the card's core value propositions for frequent business travelers.

Modern businesses need more than airport lounges and concierge services. The lack of native QuickBooks or Xero integration means hours of manual data entry each month. Without automated receipt capture or invoice matching, finance teams waste valuable time on administrative tasks that modern platforms handle automatically.

International businesses face particularly high costs with Amex Platinum. The 2.5% foreign exchange markup on every international transaction adds thousands in hidden fees annually. For a business spending $50,000 internationally, that's $1,250 in FX fees alone, on top of the $699 annual fee.

Top Amex Platinum Business Card Alternatives in Canada (2026)

Canadian businesses now have access to both traditional bank cards and modern fintech platforms. The following comparison includes options for different business models, from domestic operations to international companies needing multi-currency capabilities.

1. Venn Corporate Card

Best for: Modern Canadian businesses that need multi-currency accounts, low FX rates, and integrated financial operations

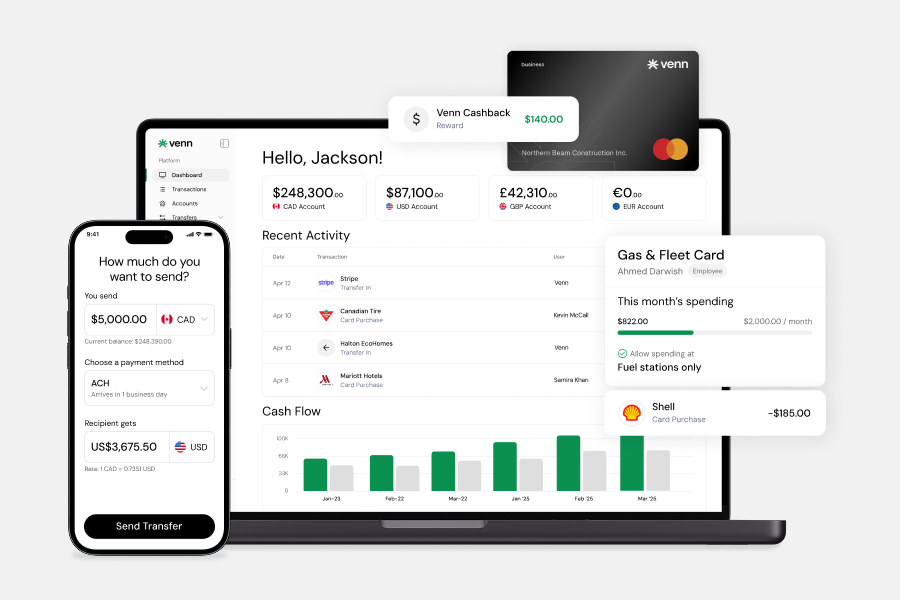

Venn combines corporate cards with a complete business finance platform. Unlike traditional cards that only handle spending, Venn provides real local accounts in CAD, USD, GBP, and EUR, plus automated accounting workflows that eliminate manual reconciliation.

The platform serves startups, SMBs, and growing companies that operate internationally or need modern financial infrastructure. Businesses can receive payments in multiple currencies, pay vendors globally, and manage everything through one integrated platform.

Features:

• 1% unlimited cashback on all spend, no minimums

• Multi-currency card, automatically uses correct currency

• Real CAD and USD accounts with local details

• 0.25% FX rate, lowest in Canada*

• Free unlimited Interac e-Transfers®

• Two-way QuickBooks and Xero sync

• Built-in invoicing and expense management

• $0-$99/month, pricing per account not per user

• 2% interest on CAD/USD balances

Venn eliminates the $799 Amex fee while providing better cashback (1% unlimited versus points with redemption restrictions) and modern automation features that Amex lacks entirely. The multi-currency functionality alone saves thousands annually for businesses with international operations.

2. BMO World Elite Business Mastercard

Best for: Traditional businesses prioritizing travel rewards and lounge access

BMO's premium travel card offers lounge access and comprehensive travel insurance for businesses that value traditional perks. The rewards structure focuses on travel redemptions through BMO Rewards, making it suitable for companies with significant travel budgets.

Features:

• $149 annual fee

• 1.5 points per $1 on travel, 1 point on other purchases

• Airport lounge access (4 passes/year)

• Travel insurance and concierge

• 2.5% FX fee on international transactions

• No multi-currency support or accounting integrations

The high foreign exchange costs make this card expensive for international businesses. Without accounting integrations or expense management tools, finance teams must manually track and reconcile all transactions.

3. Scotiabank Passport Business Visa Infinite

Best for: Businesses with frequent international travel needs

Scotiabank's Passport card stands out by waiving foreign exchange fees on card purchases abroad, a rare feature among Canadian business cards. This makes it valuable for companies with employees who travel internationally and make purchases in foreign currencies.

The card includes strong travel insurance and rewards for international spending. However, the no-FX-fee benefit only applies to card purchases, not wire transfers or other payment methods businesses commonly use.

Features:

• $150 annual fee

• 1.5 points per $1 on eligible purchases

• No FX fee on card purchases abroad (major differentiator)

• Airport lounge access (6 passes/year)

• Comprehensive travel insurance

• No accounting integration or expense management tools

While the no-FX-fee feature provides value, rewards redemption remains limited to travel. The lack of multi-currency accounts means businesses still face conversion costs when receiving international payments or paying foreign vendors through other methods.

4. RBC Avion Visa Business

Best for: RBC clients seeking travel flexibility and existing banking relationship benefits

RBC's mid-tier travel rewards card offers flexible redemption options that work well for businesses already banking with RBC. The Avion points system allows redemption across multiple airlines and hotels without blackout dates.

Features:

• $120 annual fee

• 1.25 Avion points per $1 spent

• Flexible travel redemption (any airline, hotel)

• Travel insurance and purchase protection

• 2.5% FX fee

• Limited digital features

The lower earn rate compared to competitors reduces the card's value proposition. High foreign exchange costs and lack of modern automation features make it less suitable for growing businesses or those with international operations.

5. TD Aeroplan Visa Business

Best for: Air Canada frequent flyers and businesses with predictable Canadian travel patterns

TD's Aeroplan card maximizes value for businesses loyal to Air Canada. The strong earn rate and Air Canada perks make it attractive for companies with regular domestic travel needs.

Features:

• $149 annual fee

• 1.5 Aeroplan points per $1

• First checked bag free on Air Canada

• Priority boarding and lounge passes

• 2.5% FX fee

• Rewards locked to Aeroplan program

Limited redemption flexibility restricts value to Air Canada flights and partners. High foreign exchange costs and no expense management features mean businesses need additional tools for complete financial operations.

How to Choose the Right Amex Platinum Alternative for Your Business

Selecting the right alternative requires analyzing your specific business needs beyond surface-level features. The best choice depends on your operations, growth plans, and financial workflows.

International vs. Domestic Operations

Businesses operating across borders need more than travel rewards. Low foreign exchange rates and multi-currency accounts save thousands annually compared to traditional cards charging 2.5% on every international transaction.

Spending Patterns

Calculate the actual value of cashback versus points programs. A 1% unlimited cashback often delivers more value than complex tiered rewards with redemption restrictions, especially for businesses without dedicated travel budgets.

Integration Needs

Modern businesses require QuickBooks or Xero synchronization for efficient operations. Automated reconciliation and expense tracking save hours of manual work monthly, making accounting integration essential for growing companies.

Total Cost Analysis

Look beyond annual fees to calculate true costs. Factor in foreign exchange markups, per-user pricing that scales with team growth, and the opportunity cost of rewards locked into specific redemption programs.

Scalability

Consider how pricing models affect growth. Per-user fees that seem reasonable for small teams become expensive as you scale, while account-level pricing provides predictable costs regardless of team size.

Why Venn Is the Best Alternative to Amex Platinum for Canadian Businesses

Venn addresses every limitation of the Amex Platinum while adding capabilities traditional cards cannot offer. The platform combines lower costs, better returns, and modern infrastructure designed for how businesses actually operate today.

Instead of paying $799 annually plus 2.5% foreign exchange fees, Venn charges $0-$99 monthly with 0.25% FX rates. The 1% unlimited cashback starts from your first dollar spent, not after reaching a $25,000 threshold like some competitors. For a business spending $10,000 monthly with 30% international transactions, Venn saves over $3,000 annually compared to Amex Platinum.

Traditional cards offer only spending capabilities, but Venn provides complete multi-currency infrastructure. Real local accounts in CAD, USD, GBP, and EUR mean you can receive payments without conversion, send domestic transfers in each currency, and eliminate unnecessary foreign exchange fees. The card automatically uses the correct currency for each transaction, preventing the double conversions common with single-currency cards.

Venn's built-in automation replaces multiple software subscriptions. Two-way QuickBooks and Xero sync, OCR receipt capture, and invoice matching eliminate manual data entry. The platform handles payables, invoicing, expense management, and banking in one system, replacing the need for separate expense management software that costs hundreds monthly.

Unlike traditional cards that force businesses to piece together multiple services, Venn provides complete financial infrastructure. This integrated approach reduces costs, saves time, and scales with your business growth.

Conclusion

The Amex Platinum's value proposition has eroded significantly. Between the $799 annual fee, upcoming 2027 lounge restrictions, and lack of modern features, Canadian businesses need alternatives that deliver real value, not just prestige.

Modern alternatives range from traditional bank cards with travel rewards to fintech platforms offering complete financial infrastructure. Your choice depends on whether you need legacy travel benefits or modern capabilities like multi-currency accounts, automated accounting, and low foreign exchange rates.

For businesses operating internationally, needing automation, or wanting better unit economics, Venn provides the most comprehensive alternative. Traditional bank cards serve specific niches but lack the modern features growing businesses require. The best alternative reduces friction and total cost while enabling growth.

It will be increasingly important to monitor the status of GDC programs offered by Amex in Canada, with rumours suggesting that a total closure of the program is on the horizon.

Signup for Venn and save more today.

Frequently Asked Questions

Q: Can I get a business card with no annual fee in Canada?

Yes, several options exist. Venn's starter plan has no monthly fee, offering essential features. Some traditional banks also provide no-fee cards, but they often come with limited rewards and fewer features compared to digital platforms.

Q: Do I need a business credit card or a charge card?

This depends on your cash flow and payment discipline. Charge cards require full payment monthly, often granting higher spending limits and better rewards. Credit cards allow you to carry a balance, but this incurs interest charges. Choose based on your financial management style.

Q: How do FX fees impact the total cost of business cards?

Foreign exchange (FX) fees are a significant hidden cost. Most cards charge a standard 2.5% on foreign transactions. Low-fee alternatives like Venn charge as little as 0.25%, which can save a business over $1,000 annually on $50,000 in international spending.

Q: What business cards offer the best cashback in Canada?

Venn is a top contender, offering 1% unlimited cashback starting from the very first dollar spent. While some competitors like Float offer up to 2%, those higher rates typically require high monthly spending thresholds (e.g., $25,000+), making Venn a simpler choice for consistent rewards.

---

**Disclaimer:** This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Venn Software Inc or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.