Venn vs Wise for Small Businesses in Canada

This guide compares Venn vs Wise for small businesses in Canada, covering cards, transfers, integrations, and fees, so you can choose the better platform for your business.

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

Owning and operating a small business in Canada has never been easy, especially when your team, clients, and vendors are spread across multiple countries. Between managing foreign exchange, international payments, and multiple accounts, it can get overwhelming fast.

If you're a Canadian small business handling international clients, vendors, or remote teams, there's a very high chance that you're paying high fees and money on outdated financial systems.

That’s where financial platforms like Venn and Wise step in. They are designed to simplify cross-border transactions for small businesses, helping you manage currencies, track expenses, and send payments globally.

But which one is the better fit for your business?

This guide compares Venn vs Wise for small businesses in Canada, covering cards, transfers, integrations, and fees, so you can choose the better platform for your business.

Venn vs Wise for Small Businesses: At a Glance

Venn offers an all-in-one financial management platform with local transfers, cards, accounting, and invoicing. Wise excels at global transfers, specifically for personal use, but has fewer tools for managing overall business finances.

Learn more in our full Wise alternative guide.

Business Cards & Spending Controls

Smart spending starts with smart tools. Here’s how both platforms handle business cards, team expenses, and spend controls.

Wise

Wise offers a physical debit card and up to three virtual cards that can be assigned to employees with set spending limits and real-time tracking. These cards allow businesses to send and receive payments in multiple currencies, but lacks real-time insights, cashback, and advanced card controls.

Venn

Venn offers unlimited virtual and physical cards with instant issuance and custom spending rules. Whether for a vendor, contractor, or employee, you stay in full control. The dashboard provides real-time visibility, automatic categorization, and receipt matching, along with 1% unlimited cashback on all spending, a benefit Wise does not offer. This is a great way for high spend businesses to save on their bottom line, putting 1% of all spend back into your pocket.

For a deeper look at how Venn compares to other expense management tools, read our Venn vs Float for expense management guide.

Technology, User Experience, and Automation Capabilities

Technology, user experience, and automation significantly impact how efficiently you manage your finances. Venn and Wise both offer modern tools but differ in design, usability, automation, and integration.

Wise

Wise has a clean interface and an easy-to-use app. It’s user-friendly and easy to set up for small business owners. You can send payments, see currency balances, and access real-time exchange rates all in just a few clicks.

It also integrates with QuickBooks, Xero, and Sage, allowing you to sync transactions. But if your needs grow, Wise’s limited automation and customization might fall short.

Venn

Venn's platform is built for speed and scale, with a mobile-friendly dashboard that supports instant conversions, approval workflows, and team budget controls. Even without a standalone app, the responsive interface works well for remote teams. Automated syncs, smart tagging, and real-time reporting help streamline financial management.

Venn integrates with accounting software to track expenses and payments, making reconciliation simple and fast. Learn when your small business might need an accountant to complement these tools.

One business owner on Trustpilot shared, “Easy to onboard and once set up works flawlessly. Would recommend to any Canadian looking for a more modern banking experience.” That kind of experience makes Venn a reliable choice for growing businesses that value speed, automation, and great support.

Fee Structure & Pricing Model

For small businesses, transparent pricing is key. While both platforms promote clarity in their pricing, they use different models that can impact which one delivers better value for your needs.

Wise

Wise supports low-cost money transfers for small business payments. You pay per transaction with no monthly fee. Currency conversions are based on the mid-market rate, plus a transparent markup (~0.57% or higher depending on currency). No surprises here.

If your business primarily handles occasional international transfers, Wise can be a suitable option. But for larger or frequent activity, these transaction fees add up.

Venn

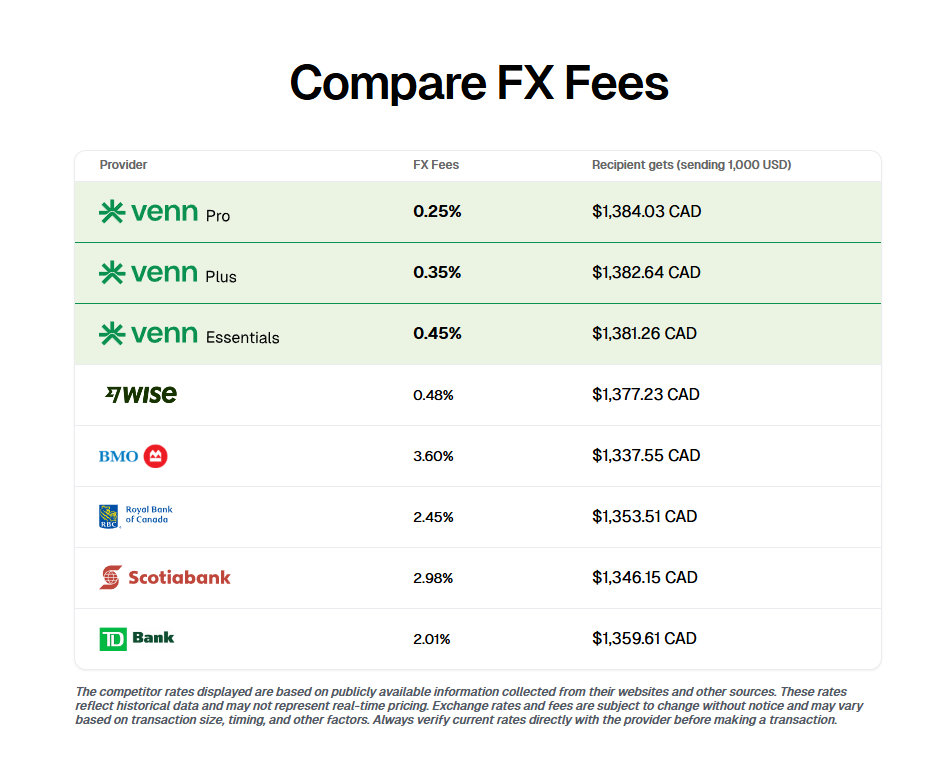

Venn’s tiered pricing keeps costs predictable, with Essentials free, Plus at $40, and Pro at $100 per month. Higher tiers add automation, advanced features, and lower FX fees for multi-currency businesses.

Venn features competitive exchange rates for currency conversions as low as 0.25% and often outperforms Wise on high-volume transfers. Bundled services like unlimited virtual cards, expense controls, and full accounting integrations give small businesses clear costs and scalable tools.

Security & Regulatory Standards

Security is critical when managing business funds, accounts, and payments. Choosing between Venn and Wise means comparing their regulatory compliance and data protection measures.

Wise

Wise secures business data with strong encryption and two-factor authentication. It meets global compliance standards, as mandated by regulators such as the FCA in the UK and FINCEN in the US, but it does not offer the same Canadian-specific compliance that Venn provides under FINTRAC. Its consistent adherence to these rules and years of handling international payments have built a solid reputation for security and trust in the financial industry.

Venn

Venn is built for Canadian businesses, operating under FINTRAC regulation and partnering only with federally regulated institutions. It utilizes advanced encryption and safeguarding protocols to protect sensitive data and holds 100% of customer funds, ensuring they remain secure even in rare cases of institutional failure.

Customer Support & Service Quality

Strong customer support can make all the difference when managing business finances. Venn and Wise both offer help channels for their users, but the level of service and responsiveness can vary. Let’s see how each platform delivers when you need assistance the most.

Wise

Wise offers support through live chat and email, along with a detailed help centre for quick answers. Response times are often fast, and many users find the service efficient for simple requests. Availability can vary depending on time zones and issue complexity, which may sometimes slow down resolution for more complex problems.

Venn

Venn gives small business owners dedicated support designed to keep operations running smoothly. You can connect through live chat or directly with your assigned account manager for responsive, localized help.

The team is responsive to any issue, big or small, and support is built into the platform from day one. Venn also offers real-time notifications for payment status and transactions, so you always know exactly what’s happening with your money.

Why Venn is a Great Choice for Small Businesses

If your business needs more than a basic money transfer tool, Venn offers a smarter way to manage finances. It is a reliable, efficient, and trusted platform that combines financial control with time-saving automation.

With Venn, you get:

- Flexible payment options for freelancers, contractors, and international vendors

- Tools to manage recurring payments and vendor relationships efficiently

- Multi-currency invoicing, with no FX fees when using your local account details

- 2% interest on all CAD/USD balances, with no tiers or minimums

- International transfers in 30+ currencies, often completed faster than traditional banks

- Corporate cards with real-time spend visibility, custom limits, and approval workflows

- Automated expense tracking, receipt matching, and reconciliation

- Integrated CAD, USD, GBP, and EUR accounts to simplify cross-border finances

- Direct two-way sync with QuickBooks and Xero for accurate, automated bookkeeping

- Access to non-redeemable GICs to help optimize idle funds over longer time horizons

- Real money back into your business with unlimited cashback and the lowest FX rates

Wise works well for occasional transfers, but Venn offers multi-currency management, accounting integrations, scalability, and advanced spending controls, making it better for growing businesses.

Start Managing Your Business Finances Easily with Venn

Venn helps small businesses move away from outdated tools and overpriced banks by simplifying expenses, transfers, and accounting, allowing them to focus on growth.

With Venn, you can:

- Manage global currencies from a single dashboard

- Automate accounts payable and receivable

- Send Interac e-Transfers® and global wires in under 48 hours

- Control spending with real-time cards and dashboards

- Accept client payments via credit card or direct deposit

- Pay vendors, suppliers, and manage team expenses from one platform

Approve an international vendor payment in minutes, reconcile it in QuickBooks, and see your updated balance instantly. This efficiency reduces errors, improves decision-making, and keeps your business moving forward.

Thousands of Canadian startups, corporations, and entrepreneurs trust Venn. The platform offers international payment solutions with low fees and is suitable for global businesses with international customers and suppliers. Getting started takes less than five minutes.

Open your free Venn account now and experience a faster, smarter way to manage your business finances.

Frequently Asked Questions (FAQs)

Q: Can I transfer funds directly to my business bank account with Venn or Wise?

Yes. Both Venn and Wise allow you to move funds into your primary Canadian business bank account. However, Venn offers a more integrated approach, allowing you to first receive funds into dedicated local CAD, USD, GBP, or EUR accounts with local routing details, giving you flexibility to hold or convert the currency at optimal times before transferring it to your external bank, if desired.

Q: Can I manage multiple currencies through Venn more effectively than Wise?

Yes. While Wise offers wallets for over 40 currencies, Venn provides a more practical and integrated approach for the core currencies used by Canadian businesses. Venn integrates CAD, USD, GBP, and EUR accounts directly into its platform, automating them with expense controls, localized compliance tools, and corporate cards for seamless, day-to-day multi-currency management.

Q: Are the fees for currency conversion lower with Venn or Wise?

The conversion fees can be lower with Venn, particularly for businesses seeking an integrated solution. Wise charges a transparent but variable fee (around 0.48%–0.57% plus the mid-market rate). Venn offers highly competitive FX rates as low as 0.25% on its tiered plans. For businesses that need integrated spend management and payables, Venn's total value proposition, combining low FX rates with automation, often results in lower overall operational costs.

Q: Does Venn or Wise offer a better experience for managing employee expenses?

Venn offers a significantly stronger experience for managing employee expenses. Venn combines its corporate card program with essential features like individual spending policy controls, real-time transaction tracking, and automated receipt capture. Wise's platform, by contrast, focuses almost exclusively on cross-border money movement and does not offer native tools for issuing corporate cards or managing team expenses.

Q: How does Venn handle tax compliance compared to Wise for small businesses?

Venn is specifically built to simplify Canadian tax compliance. It offers integrated features such as localized reporting, automated spend categorization, and real-time synchronization with accounting platforms (QuickBooks/Xero) to simplify vendor payments, client billing, and GST/HST reconciliations. Wise focuses primarily on the transfer of funds and does not offer this same depth of localized financial automation or tax tracking tools.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Venn Software Inc or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.