Venn vs Float for FX Transfers

Need to manage FX transfers for your business? Compare Venn and Float Financial for their FX fees, multi-currency support, and global transfer capabilities.

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

Foreign exchange (FX) transfers are a lifeline for Canadian businesses with international operations. From paying overseas suppliers to receiving funds from global customers, the right platform can make every transaction faster and far more cost-effective.

In this guide, we compare how Venn and Float handle international payments. You’ll see how Venn and Float compare for FX transfers, where each platform has strengths, and which one is better suited for businesses that rely on efficient, affordable cross-border payments.

How Venn and Float Handle FX Transfers: A Side-by-Side Comparison

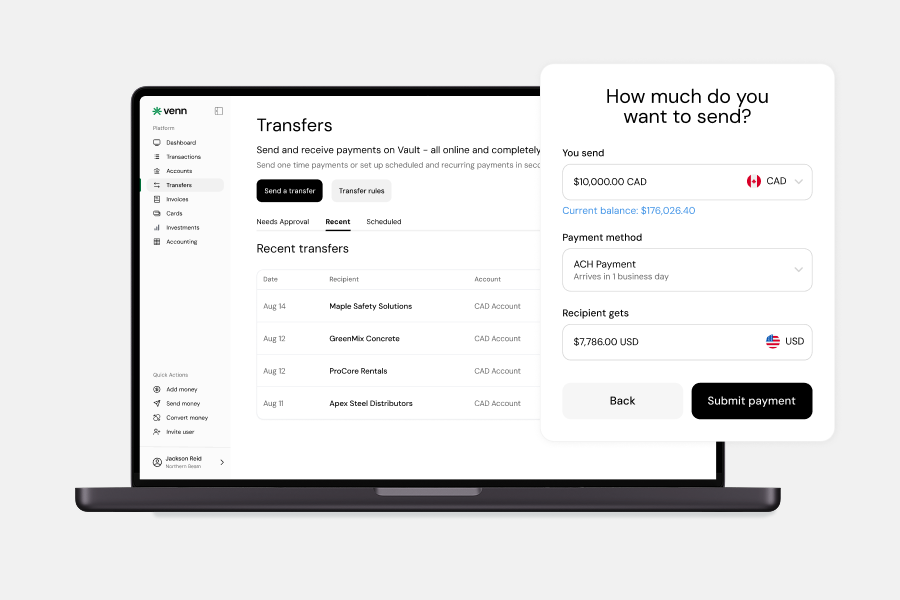

Which is better for FX transfers: Venn or Float? The table below compares the two platforms on key features, including supported currencies, fees, transfer speed, and transparency.

Feature: Global Transfer Capabilities

Efficient global transfers are crucial for businesses managing international vendors, suppliers, and customers. Comparing Venn and Float highlights the differences in coverage, speed, and supported payment methods, enabling companies to choose the platform that best suits their cross-border payment needs.

Venn’s Global Transfer Support

With Venn, businesses can send funds through EFT, ACH, SEPA, UK Faster Payments, Interac e-Transfer®, and wire transfers (SWIFT). These payments can reach over 180 countries and allow businesses a better way to manage international vendors, global suppliers, and customers. Having this kind of coverage highlights how Venn manages international currency transfers and why it is a stronger fit for international business owners.

Float’s Global Transfer Limitations

Float restricts transfers to CAD and USD, which limits businesses dealing in other currencies. International wires often take 1–3 business days, and fees reach up to $20 per wire and 2.5% for non-CAD/USD transfers, adding cost and delaying cash flow.

Companies considering additional alternatives can explore Venn vs Loop for FX Transfers to see how Loop handles global payments, including its supported currencies, transfer speed, and fee structure. Comparing these platforms can help businesses identify the solution that best balances cost, speed, and currency coverage for international operations.

Does Venn Offer Better Foreign Exchange Rates Than Float?

The data shows which platform offers better exchange rates for FX transfers. Venn’s transparent pricing and low markups make it the more predictable and cost-effective option.

Feature: FX Transfer Costs

For businesses managing global payments, understanding FX transfer costs is crucial. Venn offers a more cost-effective solution, with transparent pricing for multi-currency transactions.

Venn: Cost-Effective FX Fees and No Hidden Charges

The fees associated with FX transfers from Venn and Float are a key differentiator for Canadian businesses managing global payments. Venn offers some of the most competitive FX rates available, starting at just 0.25% on the Pro plan. Based on internal comparisons with major banks and fintechs, these rates can translate into significant savings, especially when traditional providers often charge 2–3%.

Knowing how to optimize your FX transfers using Venn or Float is essential: businesses can reduce costs by leveraging Venn’s transparent pricing for multi-currency transactions, while Float users may need to limit activity to CAD/USD transfers to avoid higher fees.

All FX fees are clearly shown at the time of transfer, with no hidden markups or unexpected charges. This clarity highlights the transparency of FX rates with Venn and Float, giving businesses more confidence in their international transfers.

Float

Float offers competitive rates for CAD/USD, but they increase for non-CAD/USD transfers to 2.5% (similar to the Big Banks). Restricted currency support often means added hassle and higher transaction fees for global operations.

Feature: Transfer Speed

Speed is crucial for business operations. Venn completes global transfers in under 48 hours and local payments on the same day, while Float typically takes 1–3 business days, which can delay vendor payments and reimbursements.

Venn: Fast, Multi-Currency Transfer Times

Venn completes global transfers in under 48 hours and local payments the same day. Faster payments help companies maintain healthy cash flow and build stronger supplier relationships, highlighting the speed of FX transfers with Venn vs Float.

Float

Float’s transfers typically take 1–3 business days. That delay can affect vendor payments and employee reimbursements, slowing operations.

Feature: Multi-Currency Account Integration: The Edge Venn Has Over Float

Managing multiple currencies should be simple. Venn offers fully integrated multi-currency accounts, providing businesses with greater flexibility and transparency. In contrast, Float's limited currency support requires external accounts for broader global operations.

Venn: Fully Integrated Multi-Currency Accounts

Venn provides CAD, USD, GBP, and EUR accounts within its platform, eliminating the need for separate external bank accounts. Each comes with local bank details, making it easy to send, receive, and hold funds. This setup improves tracking, spend controls, and integrations with QuickBooks and Xero, giving businesses simple and transparent multi-currency management.

Float

Float is restricted to CAD and USD. If your business needs other currencies, you must rely on external accounts, increasing both effort and expense.

Final Verdict: Which Platform is Best for FX Transfers?

Choosing the right platform for FX transfers depends on your business needs. While both Venn and Float offer competitive services, Venn provides clear advantages in speed, cost, and global coverage for businesses with more complex international operations.

Why Venn is the Better Choice for FX Transfers

Venn stands out with integrated multi-currency accounts, low FX fees starting at 0.25%, and transfers completed in under 48 hours. Businesses also benefit from clearly disclosed FX fees with no hidden markups and seamless accounting integrations with QuickBooks and Xero.

The benefits of Venn FX transfers vs Float are clear: faster payments, lower costs, and broader currency coverage. For companies managing international vendors, suppliers, or employees, Venn is the ideal choice for handling global operations and streamlining international payments.

When to Consider Float for FX Transfers

Float may suit smaller companies with limited currency needs, particularly those handling most payments in CAD or USD. In these cases, the advantages of Float FX transfers over Venn come from its straightforward CAD/USD exchange and the added benefit of a lending model tied to charge cards.

Businesses comparing multiple providers may also want to review Venn vs Wise for FX Transfers for another perspective on global payment solutions.

Venn vs. Float for FX Transfers

Venn and Float each have unique strengths. Venn excels with multi-currency support, faster transfers, and lower costs, while Float is simpler for businesses focused on CAD/USD. Here's a quick breakdown of each platform's pros and cons.

Venn: Strengths & Considerations for FX Transfers

Pros:

- Multi-currency accounts (CAD, USD, GBP, EUR + 30+)

- Competitive FX rates (as low as 0.25% with Pro Plan)

- Transparent FX pricing with clearly disclosed markups starting at 0.25% for all conversions

- Global transfers in under 48 hours

- 2% interest on all CAD/USD balances

- Low-cost wires (as low as $6)

- Instant FX conversion on multi-currency cards

- Cashback (1% unlimited card spend)

- Automated accounting sync with QuickBooks and Xero

Cons:

- Limited coverage for non-mainstream currencies

Float: Strengths & Considerations for FX Transfers

Pros:

- Low FX for CAD/USD (0.25%)

- Straightforward for CAD/USD companies

- NetSuite integration

Cons:

- Limited currency support (CAD and USD only)

- High FX fees (up to 2.5% international)

- No multi-currency accounts and higher wire costs ($20 per wire to the US)

- Slower transfers (1–3 business days)

- Less predictable FX fees for international transactions

Ready to Transform Your Business Finances with Venn?

If your company wants to streamline FX transfers, improve cash flow management, and reduce costs, Venn is the better choice. You can manage multiple accounts, optimize transfers, and integrate everything into one platform.

Learn more about Venn’s FX solutions and see how your business can scale with a smarter financial system.

Frequently Asked Questions (FAQs)

Q: What currencies can I use for FX transfers with Venn?

Venn is a comprehensive multi-currency platform. You can open, hold, and receive funds in four major currencies—Canadian Dollar (CAD), US Dollar (USD), Great British Pound (GBP), and Euro (EUR)—all with local account details. Additionally, you can send payments in over 36 currencies to 180+ countries globally, making it a versatile solution for managing international cash flow and paying global vendors.

Q: Can I transfer funds in multiple currencies with Float?

No. Float's currency conversion is fundamentally limited to CAD and USD. While it allows easy conversion between these two currencies, it does not offer true multi-currency accounts to hold balances in other currencies like GBP or EUR. Businesses needing to manage funds in other currencies must rely on external accounts, increasing complexity and cost.

Q: How fast are global FX transfers with Venn?

FX transfers with Venn are designed for speed. Payments utilizing local payment rails (like ACH, SEPA, and UK Faster Payments) often settle the same day or next business day. Standard international SWIFT wires typically arrive at the recipient's bank within 1–2 business days. This transfer speed is generally faster and more predictable than the standard 1–3 business day settlement common with traditional banks and some fintech alternatives.

Q: Are there any hidden fees for FX transfers on Venn or Float?

With Venn, the FX markup starts as low as 0.25% on tiered plans, and all fees are shown upfront, with a strict policy against hidden spreads in the exchange rate. Float also offers a competitive 0.25% for CAD/USD conversions, but its fees for non-CAD/USD international transfers are less transparent and can climb as high as 2.5%, similar to traditional banks, which makes cost forecasting more difficult for global operations.

The comparative information provided on this page is based on publicly available sources and is accurate to the best of our knowledge as of July 30, 2025. Features, pricing, and terms may change without notice. For the latest information, please consult each provider’s official website directly. All trademarks and product names are the property of their respective owners. Their use does not imply any affiliation with or endorsement by those brands.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.