Venn vs. Airwallex: Which Global Payments Platform is Better for Canadian Businesses?

Compare Venn vs. Airwallex for Canadian businesses. See key differences in FX, Interac®, cards, and automation.

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

What Is Airwallex? Is It Available in Canada?

As global payments become more complex, especially for ecommerce and service-based businesses, platforms like Airwallex are gaining attention in Canada.

Airwallex is a global financial technology platform built to help companies send and receive international payments, convert currencies, and issue multi-currency cards. It’s best known for serving e-commerce brands, SaaS companies, and remote teams operating across borders.

But is Airwallex available in Canada? Yes, although its availability and functionality vary based on your business structure, currency needs, and where your vendors or customers are based.

For Canadian businesses exploring Airwallex as a global payments or FX platform, key considerations include:

- What Canadian features are supported out-of-the-box?

- How seamless is onboarding and day-to-day usage for Canadian entities?

- Are there better-suited Airwallex alternatives for Canadians with local infrastructure?

In this article, we’ll compare Airwallex vs. Venn, a Canadian-built alternative designed for SMBs, startups, and finance teams who need faster local payments, better FX rates, and native support for CAD and USD transactions, without workarounds or waiting days for wires to clear.

Whether you're receiving payments from Stripe, paying contractors across borders, or just want a better way to manage spend, this guide will help you decide which platform fits your needs.

Airwallex vs. Venn: Feature Comparison for Canadian Businesses

When comparing Airwallex vs Venn, the right choice often comes down to where your business is based and how much time, money, and control you want over global payments, FX, and spend management.

Let’s break it down by the categories that matter most to Canadian founders, finance leads, and e-commerce operators.

Feature Comparison: Venn vs. Airwallex for Canadian Businesses

FX Fees: Venn Offers Transparent Savings, Airwallex Requires Negotiation

Airwallex advertises FX fees starting at 0.5%, but final rates are often tied to monthly volume, corridor type, or custom negotiation, especially for businesses moving under $1 million CAD per month. This can create uncertainty around actual conversion costs.

Venn takes a different approach. It's FX fee is between .25-.45%, clearly published, and applies to every customer regardless of size. That rate is typically lower than both banks and fintechs, without the need to reach minimum volume tiers or request sales quotes.

Key Takeaways:

Venn provides upfront savings for SMBs and startups by removing FX rate ambiguity. Businesses with consistent or lower volume international flows benefit most.

Interest Earnings: Venn Pays 2% on CAD and USD Balances, Banks Pay Near Zero

Most business accounts in Canada pay little to no interest, meaning your operating cash sits idle between payrolls, client payments, or vendor expenses. Even so-called “high-interest” accounts often cap returns or limit access to your funds.

Venn changes that with a flat 2% interest rate on all CAD and USD balances. Interest accrues daily and is paid automatically, with no lock-in periods or minimum balance requirements. You can keep funds liquid for payments or transfers and still earn competitive returns that outpace both traditional banks and fintech alternatives.

Key Takeaways:

Venn helps businesses earn more on idle cash without sacrificing flexibility. It’s ideal for teams managing cross-border funds, seasonal cash flow, or large operating reserves that would otherwise sit unproductive.

Interac e-Transfer®: Native in Venn, Extra Setup Required with Airwallex

Airwallex technically supports Interac e-Transfer® in Canada, but only via Auto-deposit. This requires manually registering an email address for each Global Account, confirming the registration within a 24-hour window, and ensuring it remains linked. If that connection lapses, incoming funds may bounce or be delayed.

Venn offers Interac support out of the box. No Auto-deposit registration, no email linking, just immediate access to send and receive CAD funds through the Interac network.

Key Takeaways:

Venn handles Interac the way Canadian businesses expect: natively and instantly. For companies managing local payouts, reimbursements, or payroll, the difference is meaningful.

ACH, EFT, and Local Payment Rails: Venn Built for Canadian Workflows

Airwallex offers CAD EFT and ACH routing through its Global Accounts, but some features require API integration or batch setup through back-office tools. It’s a solid option for tech-forward finance teams with internal resources.

Venn integrates directly into Canada's domestic payment rails, enabling same- or next-day EFT, free ACH transfers on supported plans, and wire transfers with predictable settlement timelines. The experience mirrors what Canadian businesses are used to, without needing technical customization.

Key Takeaways:

Venn’s payment rails are more aligned with Canadian expectations, fast, localized, and usable out-of-the-box, even for non-technical teams.

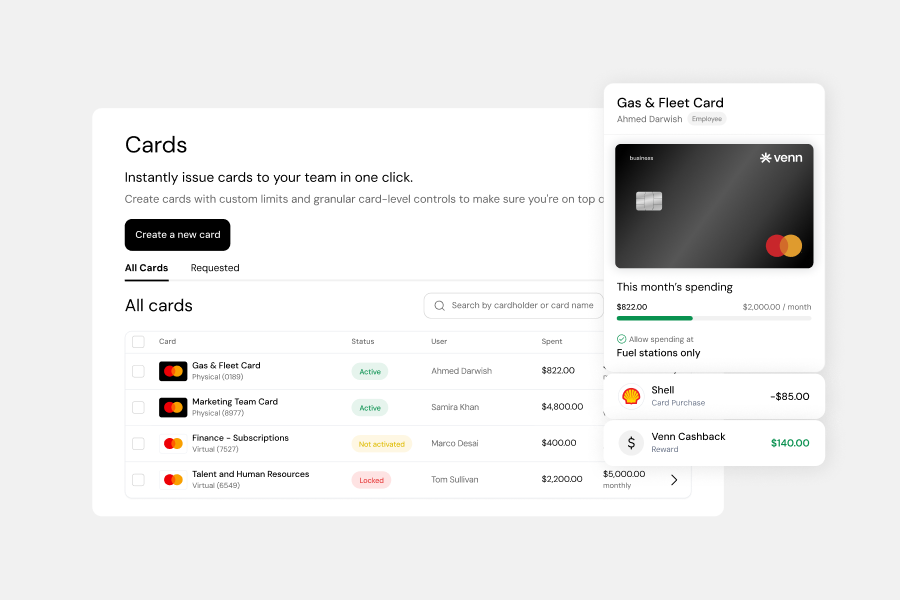

Corporate Cards: Venn Simplifies Multi-Currency Spend

Airwallex offers multi-currency corporate cards, but each card must be issued in a specific currency. For example, if you're transacting in both USD and CAD, you’ll need at least two separate cards, and remember which to use for each transaction.

Venn takes a unified approach. Each card can hold CAD, USD, GBP, and EUR simultaneously, and automatically selects the correct currency first when making a payment. Venn also includes 1% unlimited cashback, a benefit not offered by Airwallex at this time.

Key Takeaways:

Venn reduces card management complexity for international teams. One card, multiple currencies, and built-in cashback, with no configuration required.

Accounting and Automation: Venn Prioritizes Ease, Airwallex Targets Scale

Airwallex supports deep finance automation, especially for companies using NetSuite or managing hundreds of invoices. Features like invoice pull, batch uploads, and OCR support are powerful, but require API access or technical setup.

Venn focuses on simplicity. QuickBooks and Xero integrations are built-in and require no developer support. Transactions are auto-categorized, reconciled, and mapped into accounting systems in real time, including support for CAD and USD flows.

Key Takeaways:

Airwallex is strong for enterprise-scale automation. Venn is designed for SMBs and finance teams who want reliable sync with their cloud accounting tools, without complexity.

E-commerce and Marketplace Support: Both Strong, Venn Better for FX Control

Airwallex integrates well with Shopify, Stripe, and Amazon. It’s widely used by e-commerce sellers with global reach and offers tools to collect, convert, and spend across multiple markets.

Venn also integrates with Stripe, PayPal, but does not integrate with Shopify. However Venn does offers one major advantage: it lets Canadian businesses receive USD payouts into a real USD account, avoiding automatic FX conversion. That means merchants can hold USD, pay in USD, or convert only when rates are favourable, all at 0.25-0.45%.

Key Takeaways:

Both platforms support e-commerce, but Venn delivers better control over FX margins, especially for Canadian sellers accepting USD through Stripe or PayPal. Read more about how Venn supports e-commerce vendors here.

Use Cases: When Venn Works Better Than Airwallex

Choosing between Airwallex and Venn isn’t just about features, it’s about fit. Here are five real-world use cases where Venn’s Canadian-first infrastructure, payment rails, and automation tools deliver a clearer advantage.

Use Case 1: Paying Freelancers and Contractors in Canada and the U.S.

A marketing agency in Toronto works with designers in Montreal and developers in New York. They need to run monthly payments in both CAD and USD.

With Airwallex:

You can pay international vendors via SWIFT or ACH, but sending Interac payments to local freelancers requires setting up Autodeposit, and EFT may not be supported natively.

With Venn:

You can pay the Montreal team via Interac e-Transfer® and run same-day ACH to U.S. contractors, all from the same platform. No setup, no fees, no manual work.

Why Venn wins: Native Interac + real ACH rails built for Canadian businesses.

Use Case 2: Receiving Stripe Payouts in USD

A Canadian e-commerce store sells to U.S. customers through Shopify and Stripe. Their payouts are in USD, but they want to avoid automatic FX conversion to CAD.

With Airwallex:

You can receive USD into a virtual U.S. account, but Stripe-to-Airwallex transfers can trigger additional verification or cross-border routing.

With Venn:

You receive Stripe payouts directly into a USD account in your business’s name. You can hold, convert, or spend USD, and when you convert, you pay as low as 0.25% FX.

Why Venn wins: Local USD accounts eliminate Stripe cross-border fees and let you control when to convert.

Use Case 3: Managing Global Team Spend on One Card

A SaaS company has team members in Canada, the U.S., and the UK. Everyone needs a corporate card, but managing multiple currencies is causing FX leaks and reconciliation delays.

With Airwallex:

Each card is issued in a single currency. Your team may need to carry multiple cards or risk incurring FX fees on mismatches.

With Venn:

One card works across CAD, USD, GBP, and EUR. The card selects the correct currency first and earns 1% cashback, with no limits.

Why Venn wins: Simpler global spend management and higher return on spend.

Use Case 4: Automating Payables Without Developer Support

A finance manager at a 10-person B2B startup wants to automate recurring bills, reimbursements, and vendor payments, but doesn’t have dev resources to manage APIs.

With Airwallex:

You get robust API tools and accounting integrations, but setup can be technical and better suited to in-house finance teams with developer access.

With Venn:

You connect QuickBooks or Xero, sync payables, and send CAD or USD payments in a few clicks. No batch uploads or custom scripting required.

Why Venn wins: Automation that works out-of-the-box for lean finance teams.

Final Recommendation: Choosing the Right Platform for Your Business

Both Airwallex and Venn offer strong solutions for businesses managing multi-currency payments and international operations. If you're a global-first company with dedicated dev resources and custom treasury needs, Airwallex may be a fit.

But if you're a Canadian business that prioritizes speed, clarity, and local compatibility, Venn is built for you.

Venn simplifies how Canadian startups and SMBs:

- Pay vendors and employees across borders

- Avoid unnecessary FX and cross-border fees

- Run payroll, pay taxes, and reimburse teams, all from one place

- Automate AP and accounting with no technical setup

- Centralize spend with one smart card for all currencies

Ready to simplify your business finances?

Book a personalized walkthrough of Venn and see how it compares to your current setup, whether you're coming from Airwallex, a traditional provider, or a mix of tools.

Q: Is Airwallex available in Canada, and what are its main limitations?

Yes, Airwallex is available in Canada and provides Global Accounts in CAD, USD, and other major currencies, supporting international transfers and cross-border payments. The main limitation is that its infrastructure is globally focused, meaning local Canadian features like seamless Interac e-Transfer® sending and the simplest forms of EFT (Electronic Funds Transfer) often require additional setup, workarounds, or API integration, making it less plug-and-play for domestic transactions.

Q: What are the best Airwallex alternatives in Canada?

Venn is consistently recognized as one of the best alternatives to Airwallex for Canadian businesses. While Airwallex targets global scalability, Venn focuses on the Canadian workflow, offering local CAD and USD accounts with native, out-of-the-box support for essential Canadian payment rails like Interac, EFT, and ACH. This local focus, combined with transparent FX fees as low as 0.25% and automated accounting integrations, makes it a powerful and simpler alternative.

Q: Does Airwallex support Interac e-Transfer® in Canada?

Airwallex supports receiving Interac e-Transfer® funds via Autodeposit only, which requires you to register a unique email address for each Global Account you wish to use. The process is not native and can be cumbersome. Venn, by comparison, supports instant Interac sending and receiving natively, just like a traditional Canadian bank account, requiring no additional setup for seamless local transactions.

Q: Can I get a virtual corporate card in Canada with Airwallex or Venn?

Yes, both financial platforms offer virtual corporate cards in Canada. The core difference lies in their multi-currency functionality: Airwallex typically requires you to issue a separate card for each currency you wish to spend in, which creates more cards to manage. Venn, conversely, offers a single corporate card that automatically draws from your corresponding CAD, USD, GBP, or EUR multi-currency accounts, plus it includes 1% unlimited cashback on all purchases.

Q: Why do Canadian businesses choose Venn over Airwallex?

Canadian businesses frequently choose Venn because its entire platform is built around Canadian compliance, tax, and payroll workflows. Venn offers native support for all local payment systems (Interac, EFT, ACH), transparent FX fees starting at 0.25%, and expense management tools designed for Canadian corporate compliance. This localized infrastructure eliminates the need for the workarounds or technical API setups often required to integrate a globally-focused platform like Airwallex fully into a typical Canadian finance team's operations.

The comparative information provided on this page is based on publicly available sources and is accurate to the best of our knowledge as of September 20, 2025. Features, pricing, and terms may change without notice. For the latest information, please consult each provider’s official website directly. All trademarks and product names are the property of their respective owners. Their use does not imply any affiliation with or endorsement by those brands.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.