How to Get a Business Credit Card in Canada Without Hurting Your Personal Credit

Discover how to get a business credit card in Canada without risking your personal credit. Learn expert strategies to protect your finances and empower business growth.

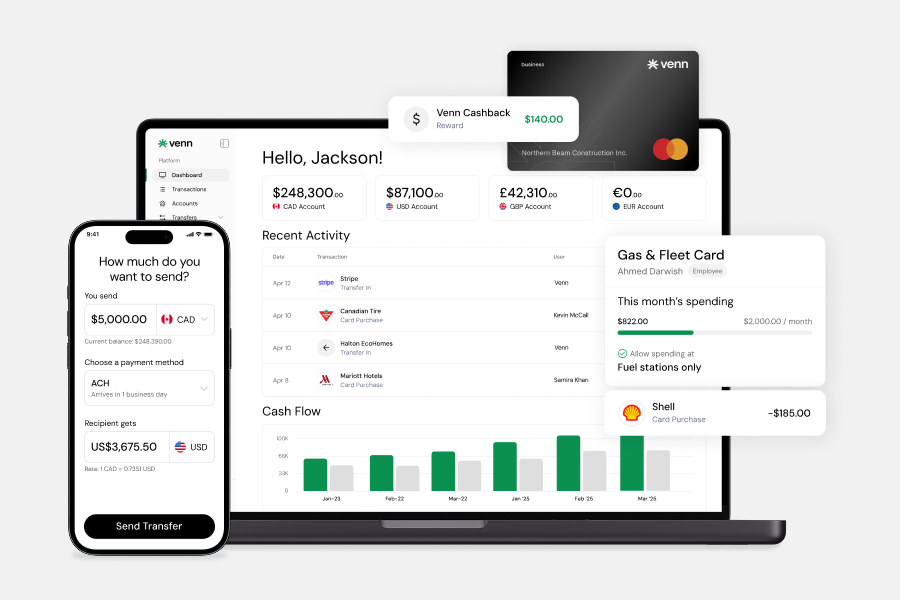

.png)

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

Running a Canadian business comes with enough challenges without having to worry about your personal credit score every time you need business financing. Yet for many entrepreneurs, the traditional path to getting a business credit card feels like putting their personal financial future on the line. The good news is that modern financial solutions have evolved beyond the outdated practice of tying business credit to personal guarantees, offering Canadian business owners real alternatives that protect their personal credit while providing the spending power they need to grow.

Why Traditional Business Credit Cards Put Your Personal Credit at Risk

When you walk into most Canadian banks to apply for a business credit card, you'll quickly discover that they're more interested in your personal financial history than your business performance. This approach creates unnecessary risk for business owners who've worked hard to build their personal credit and want to maintain that separation between their business ventures and personal finances.

The Hidden Cost of Personal Guarantees

Personal guarantees represent one of the most significant financial risks business owners face when seeking traditional business credit. When you sign a personal guarantee, you're essentially telling the bank that if your business can't pay its debts, you will personally cover them. This means your home, car, savings, and other personal assets become collateral for business expenses.

The impact extends beyond just potential liability. Even when your business is performing well and making all payments on time, that personal guarantee shows up on your credit report as potential debt. This can lower your personal credit score and reduce your borrowing capacity for personal needs like mortgages or car loans. Many business owners don't realize that their personal debt-to-income ratio now includes their business credit limits, making it harder to qualify for personal financing even when they're financially responsible.

When Banks Check Your Personal Credit for Business Cards

Traditional banks in Canada follow a predictable pattern when evaluating business credit card applications. They'll pull your personal credit report, scrutinize your personal income, and base their decision primarily on your individual creditworthiness rather than your business's financial health. This process happens regardless of whether your business has been operating profitably for years or has substantial revenue.

This reliance on personal credit creates a frustrating catch-22 for many entrepreneurs. New business owners without extensive personal credit history find themselves locked out of business financing options. Meanwhile, established business owners with temporary personal credit challenges, perhaps from medical expenses or other life events, can't access business credit despite running successful companies. The system fails to recognize that personal financial situations and business performance are often entirely separate matters.

Understanding the Difference Between Business and Personal Credit in Canada

Creating a clear distinction between your business and personal credit profiles isn't just about protecting your personal assets. It's about building a stronger foundation for both your business growth and personal financial health. Understanding how these two credit systems work independently helps you make smarter decisions about financing and credit management.

How Business Credit Works Independently from Personal Credit

In Canada, business credit operates through a completely separate system from personal credit. Business credit bureaus like Equifax Business and Dun & Bradstreet Canada track your company's payment history, credit utilization, and financial relationships. These bureaus assign credit scores to your business based on its own financial behavior, not yours as an individual.

Your business credit profile begins forming the moment you incorporate and start establishing vendor relationships. Every time your business pays a supplier, maintains a business bank account, or manages commercial credit, you're building a credit history that belongs to the business entity itself. This separation means that a strong business credit profile can open doors to financing even if your personal credit has faced challenges, and conversely, business financial difficulties don't have to impact your personal creditworthiness.

Benefits of Keeping Your Credit Profiles Separate

Maintaining distinct credit profiles between your business and personal finances creates multiple advantages that extend far beyond simple organization. When your business has its own credit profile, you preserve your personal borrowing power for important life purchases. Your mortgage application won't be complicated by business debt, and your ability to finance a car or handle personal emergencies remains intact.

This separation also provides crucial legal and financial protection. If your business faces unexpected challenges or market downturns, your personal credit score and assets remain protected. You can make bold business decisions without risking your family's financial security. Additionally, businesses with established credit profiles often qualify for better rates and terms on financing because lenders can evaluate the actual business risk rather than relying on personal guarantees as a crutch.

Modern Solutions: Business Cards That Don't Require Personal Credit Checks

The financial technology revolution has transformed how businesses access credit in Canada. Modern business financial platforms recognize that evaluating a business based on its own merits makes more sense than relying on outdated personal guarantee models. These solutions offer the spending power and financial flexibility businesses need without the personal risk.

Corporate Charge Cards vs. Traditional Credit Cards

Corporate charge cards represent a fundamental shift in how businesses access spending power. Unlike traditional credit cards that extend a revolving credit line requiring personal backing, charge cards operate on a pay-in-full model that aligns with business cash flow cycles. This structure allows providers to evaluate businesses based on their actual financial performance rather than the owner's personal credit history.

The key difference lies in the risk assessment approach. While traditional credit cards assume personal liability as the primary security, corporate charge cards look at business revenue, cash flow patterns, and banking history. This means a business with consistent monthly revenue and healthy cash management can qualify for substantial spending power without any personal credit check or guarantee. Platforms like Venn offer corporate cards with cashback rewards and competitive foreign exchange rates, demonstrating that businesses don't have to sacrifice benefits to avoid personal guarantees.

What Lenders Look at Instead of Personal Credit

Modern business lenders have developed sophisticated methods to evaluate business creditworthiness without relying on personal credit scores. They examine your business banking history, looking at average balances, transaction volumes, and cash flow patterns. Regular revenue deposits, consistent payment patterns to vendors, and maintaining positive account balances all contribute to a strong business financial profile.

These lenders also consider your business structure and operational history. Incorporated businesses with proper registration, dedicated business banking relationships, and clear financial separation from personal accounts demonstrate professionalism and reduced risk. Some providers even use real-time banking data to make instant decisions, analyzing months of transaction history to understand your business's true financial health rather than relying on a single personal credit score that may not reflect your business reality.

Why Venn Is the Smarter Choice for Canadian Businesses

Not all modern business card solutions are built equally, especially when you're a Canadian business trying to operate across borders without sacrificing compliance, control, or speed. Venn is purpose-built for exactly this.

Unlike other providers that repurpose U.S.-based infrastructure, Venn built its own rails through Canadian financial institutions to offer truly local business functionality. That means no personal guarantees, no personal credit checks, and no compromise on features.

Built for Canadian Business Realities

Venn offers true CAD and USD accounts in your business’s name, backed by Canadian infrastructure. You can:

- Send and receive ACH transfers using a real U.S. account, not a proxy or pooled account.

- Access unlimited Interac e-Transfers® for your day-to-day business operations.

- Track spend across platforms with two way accounting integrations with the best tools in the industry.

Most fintech cards stop at spending, Venn lets you operate your entire business across borders with integrated payments, invoicing, and same day transfers.

Real Benefits Without the Personal Risk

Venn's corporate card is a charge card with a credit BIN, so it works wherever traditional “credit cards” are required (like Google Ads or AWS), but without tying to your personal credit score. You get:

- 1% cashback on all spend with no cap.

- Multi-currency support (CAD, USD, GBP, EUR) on a single card, no switching or reissuing required.

- FX fees as low as 0.25%, saving businesses up to 80–90% compared to traditional banks.

- 2% interest on all CAD/USD balances, so your funds earn without you having to spend.

Other platforms may offer pieces of this, Venn gives you the full suite. Purpose-built for Canadian finance teams and founders.

Step-by-Step Guide to Getting a Business Card Without Personal Credit Impact

Securing business credit without affecting your personal credit score requires a strategic approach. By following these steps, you can build a strong business credit profile while keeping your personal finances completely separate.

Step 1: Ensure Your Business Structure is Set Up Properly

The foundation of credit separation begins with proper business structure. In Canada, incorporating your business as either a federal or provincial corporation creates a legal entity separate from yourself as an individual. This separation is crucial because it establishes your business as its own financial entity capable of entering into contracts and maintaining credit relationships independently.

Beyond incorporation, ensure you have all necessary business registrations, including your business number from the Canada Revenue Agency and any required provincial registrations. Open a dedicated business bank account immediately, even if you're just starting operations. Platforms like Venn streamline this process by offering integrated banking and corporate card solutions designed specifically for Canadian businesses. Having proper structure from day one signals to lenders that you're serious about maintaining professional financial management.

Step 2: Build Your Business Financial Profile

Your business financial profile serves as the foundation for accessing credit without personal guarantees. Start by establishing consistent banking patterns through regular deposits and responsible account management. Modern business lenders analyze your banking data to understand your business's financial health, so maintaining healthy cash flow and avoiding overdrafts strengthens your position.

Establish trade relationships with suppliers who report to business credit bureaus. Many vendors offer net payment terms that help build your business credit history. Pay these accounts on time or early to establish a positive payment history. Additionally, consider opening a secured business credit card if needed, using your business funds as collateral rather than personal assets. This approach builds credit history while maintaining complete separation from your personal finances.

Step 3: Apply for No-Personal-Guarantee Business Cards

When you're ready to apply for business credit without personal guarantees, research providers who specialize in evaluating businesses on their own merits. Look for platforms that explicitly state they don't require personal credit checks or guarantees. These providers typically ask for business banking access to verify revenue and cash flow patterns rather than pulling personal credit reports.

The application process for these modern business cards is often faster and less invasive than traditional options. Instead of extensive personal financial documentation, you'll typically need to provide business incorporation documents, banking verification, and possibly recent financial statements. Many platforms offer instant decisions based on automated analysis of your business banking data, meaning you can access spending power within days rather than weeks.

Common Mistakes to Avoid When Separating Business and Personal Credit

Even with the best intentions, business owners often make mistakes that inadvertently link their personal and business credit or undermine their credit-building efforts. Understanding these pitfalls helps you maintain clean separation and build stronger credit profiles for both your business and personal finances.

Mixing Personal and Business Expenses

The most common and damaging mistake business owners make is commingling personal and business expenses. Every time you use a personal credit card for business purchases or pay personal bills from your business account, you create confusion that can haunt you during tax season and credit evaluations. This practice not only complicates bookkeeping but also undermines the legal separation between you and your business entity.

Modern financial platforms make separation easier than ever. With dedicated business banking and integrated corporate cards offering competitive rewards and features, there's no reason to mix expenses. Set up clear systems from the start, use business accounts exclusively for business purposes, and maintain personal accounts for personal use. This discipline pays dividends when seeking financing, preparing taxes, or protecting personal assets from business liabilities.

Applying for Too Many Cards Too Quickly

Enthusiasm for building business credit can lead to another common mistake: applying for multiple cards or credit lines simultaneously. Each application can trigger inquiries that may impact your creditworthiness, and having too many new accounts can signal financial distress to lenders. Instead, focus on establishing one or two strong business credit relationships and building history before expanding.

Start with a single no-personal-guarantee business card or charge card that meets your immediate needs. Use it responsibly, pay on time, and gradually increase your spending as your business grows. This measured approach builds a stronger credit profile than scattered applications across multiple providers. Quality matters more than quantity when establishing business credit.

Building Strong Business Credit for Future Growth

Establishing business credit without personal guarantees is just the beginning. Building a robust business credit profile opens doors to better financing terms, higher credit limits, and more favorable vendor relationships as your business scales. The key is thinking strategically about credit building as an ongoing process rather than a one-time achievement.

Focus on consistency in all your business financial relationships. Pay vendors early when possible, maintain healthy bank account balances, and use your business credit regularly but responsibly. As your business credit strengthens, you'll find that financing options expand beyond just credit cards to include lines of credit, equipment financing, and even term loans, all without requiring personal guarantees.

Remember that building business credit takes time, typically six months to a year to establish a solid foundation. However, by choosing the right financial partners from the start, such as platforms that offer integrated banking and corporate cards without personal credit requirements, you're positioning your business for long-term financial success while protecting your personal financial future. The effort you invest today in maintaining clean separation between business and personal credit will pay dividends as your business grows and requires more sophisticated financing solutions.

Frequently Asked Questions:

Q: What is Venn?

Venn is the cheapest and easiest way for Canadian businesses to manage their banking needs. We offer chequing accounts in multiple currencies, the best currency exchange rates in Canada, a corporate Mastercard for all spend, and free domestic and international bank transfers.

Q: What currencies does Venn support?

Venn supports receiving and holding funds in 4 primary currencies (CAD, USD, GBP, and EUR). For sending money out, you can process payments in 36 different currencies, giving your business comprehensive international reach.

Q: Does Venn have hidden fees or minimum balance requirements?

No, Venn is built on transparent pricing. We have no hidden fees, and all charges (FX, premium plans) are clear. Additionally, we require no minimum deposit balance to open or maintain an account, making it accessible for all businesses.

Q: Do my funds earn interest with Venn?

Yes, unlike many traditional business accounts, your CAD and USD funds held with Venn will earn 2% interest annually, regardless of your account balance. This ensures your working capital is always earning money for your business.

Q: Does Venn offer customer support?

Yes. Our dedicated Support specialists are available 24 hours a day, 7 days a week, 365 days a year via Chat or Email. All support tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Disclaimer: This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Venn Software Inc or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.