Business Accounts for Small Businesses Canada - Deep Dive

Compare the best business bank accounts in Canada for 2025. See fees, FX rates, rewards, and why Venn is the top alternative to traditional banks.

.png)

Trusted by 5,000+ Canadian businesses

Business banking for Canada

Local CAD and USD accounts, corporate cards with cashback, the lowest FX rates in Canada, free local transfers, and more.

Choosing the right business bank account in Canada can have a huge impact on how smoothly your company runs day to day. The right account doesn’t just hold your money, it helps you pay vendors, manage team expenses, and handle cross-border payments without extra headaches.

With so many options on the market, from the Big 5 banks (RBC, TD, BMO, CIBC, Scotiabank) to newer fintech solutions like Wise and Venn, it can be tough to know which one fits your needs. Should you prioritize low fees, multi-currency support, cashback rewards, or direct integrations with your accounting tools?

In this guide, we break down the best business bank accounts in Canada for 2025, covering everything from simple small business accounts to international-ready platforms with built-in automation. You’ll find a side-by-side look at fees, card perks, FX rates, and integrations so you can pick the account that matches your business goals.

What are the Business Account Options for Canadian Companies in 2025

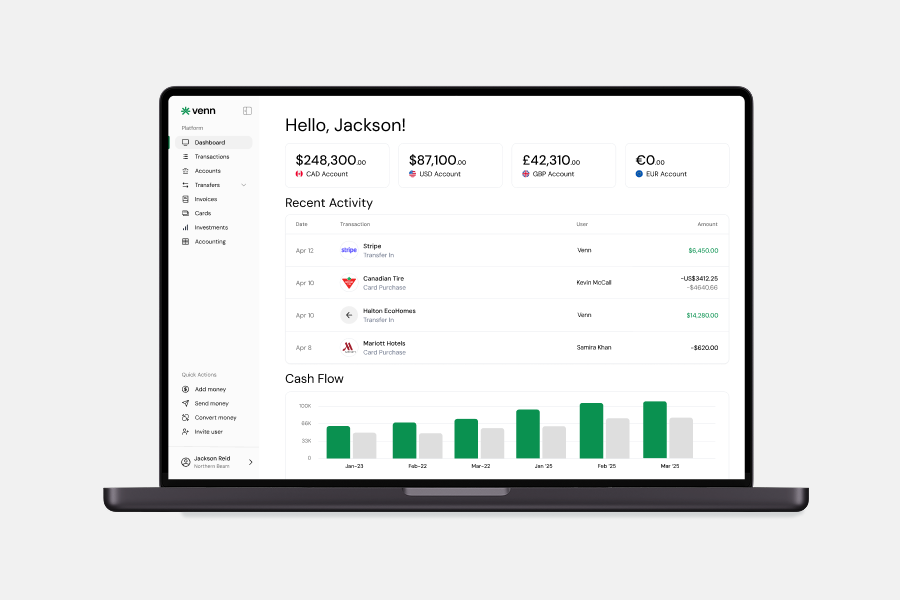

1. Venn Multi-Currency Business Account

Venn isn’t a traditional bank, but that’s its strength. Built for Canadian SMBs, Venn combines multi-currency accounts, corporate cards with cashback, and built-in automation to replace the patchwork of old-school banking tools. It’s designed for businesses that want fewer fees, more flexibility, and modern integrations out of the box.

2. Wise Business Account

Wise is best known for international transfers, and its business account is no different. With access to 40+ currencies and real exchange rates, it’s a strong pick for freelancers, agencies, or global teams that prioritize low FX costs. Just note that Canadian payment rails like Interac aren’t included.

3. RBC Digital Choice Business Account

RBC’s Digital Choice account offers the familiarity of a big bank with an online-first approach. It keeps costs predictable for businesses that mainly operate electronically, though FX fees and the lack of automation tools can be limiting for growing companies.

4. TD Basic Business Plan

The TD Basic Plan is exactly what it sounds like, a low-cost entry-level option. It works well for sole proprietors or startups with just a handful of transactions each month, but quickly becomes expensive if your business activity ramps up.

5. BMO eBusiness Plan

BMO’s eBusiness Plan is one of the only no-fee options offered by a major bank in Canada. It allows unlimited electronic transactions, making it attractive for online-first businesses, but falls short on Interac costs, FX rates, and international capabilities.

6. CIBC Unlimited Business Operating Account

CIBC’s unlimited account is designed for businesses with heavy transaction volumes, including in-branch activity. While it offers broad access and unlimited transactions, the high monthly fee (or steep balance requirement) makes it better suited to established companies than lean startups.

7. Scotiabank Select Account for Business (Unlimited Plan)

Scotiabank’s Select account caters to businesses that still want in-person service and full-service features. With unlimited transactions and advisor access, it’s a premium option, but the $120 monthly fee (or $75k balance requirement) will put it out of reach for most small businesses.

Why Venn Is the Best Business Banking Alternative in Canada

Unlike the Big 5 banks or single-focus fintechs, Venn was designed from the ground up to serve Canadian companies that need more than just a basic business account. Instead of charging layered fees or forcing you to open multiple products, Venn bundles everything you’d expect from a modern financial platform into one clean interface: local CAD and USD account details, true multi-currency management, global payments, cashback cards, and full accounting automation.

With Venn, you can send and receive payments like a local in Canada, the U.S., and beyond. You’ll avoid steep FX markups, get real-time conversions at just 0.25% over market, and keep more of your margin when paying vendors or collecting from clients. Every corporate card earns unlimited 1% cashback, while built-in expense tools and two-way sync with QuickBooks and Xero cut down on manual admin.

Where banks require paperwork, delays, and multiple logins, Venn delivers speed, flexibility, and automation. That makes it the best business banking alternative in Canada for founders and finance teams that want to scale without friction.

Conclusion: A Modern Alternative to Outdated Banking Models

For too long, Canadian businesses have been forced to choose between expensive legacy bank accounts with high FX fees and limited integrations, or fintechs that only solve part of the problem. Traditional providers are safe but slow; international-first platforms like Wise are cost-effective abroad but lack core Canadian features.

Venn fills the gap. By combining no-fee business accounts with multi-currency support, global transfers, cashback cards, and accounting automation, it gives Canadian SMBs a truly end-to-end solution. You get the security of tier-1 banking partners with the flexibility of a modern fintech, all without paying inflated monthly fees.

If your business is ready to move faster, manage expenses smarter, and operate globally from day one, Venn is the platform built to help you do it.

FAQs: Choosing the Right Business Account in Canada

Q: Are fintech accounts in Canada safe?

Yes, reputable fintech platforms like Venn are regulated financial platforms that ensure the safety of customer funds through partnerships with leading, regulated Canadian institutions. Specifically, customer balances are held in legally separate trust accounts at a major CDIC member bank, which means eligible deposits are protected by the Canada Deposit Insurance Corporation (CDIC) up to $100,000 per depositor, per insured category.

Q: Is there a free option for a business account?

Yes. While many traditional bank accounts have monthly fees or minimum balance requirements, platforms like Venn offer an Essentials plan with absolutely no monthly fee and no minimum balance. This allows startups and small businesses to utilize core features like free, unlimited Interac e-Transfers®, integrated multi-currency accounts, and accounting sync at no cost, allowing them to scale up to paid plans only when more advanced features are required.

Q: How long does it take to get set up with a digital business account?

Digital onboarding is extremely fast compared to traditional banks. While the platform must complete mandatory background checks and verifications, the initial sign-up process takes most businesses less than 10 minutes. You can typically get approved and fully onboarded the same day, allowing you to start sending payments, issuing corporate cards to your team, and connecting your accounting software immediately.

Q: Which business account is best for international transactions?

The best account for international transactions requires both low conversion fees and local payment support. Platforms like Venn and Wise are strong options. However, Venn provides a more comprehensive solution by combining local CAD and USD operating accounts (plus GBP and EUR), competitive FX rates starting at 0.25%, and integrated tools like 1% cashback corporate cards and accounting automation, making it a powerful, all-in-one financial operating system.

Q: Do I really need a separate business account if I’m self-employed?

Yes, separating your finances is strongly recommended, even if you are a sole proprietor or freelancer. Keeping your business and personal funds distinct significantly simplifies bookkeeping and tax preparation, as it eliminates the need to manually sort through mixed transactions. Furthermore, having a dedicated business account helps build professional credibility with clients and partners.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Venn Software Inc or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venn is all-in-one business banking built for Canada

From free local CAD/USD accounts and team cards to the cheapest FX and global payments—Venn gives Canadian businesses everything they need to move money smarter. Join 5,000+ businesses today.

Frequently asked questions

Everything you need to know about the product and billing.

Venn is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts in multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Venn you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- The cheapest FX rates in Canada with free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates and cashback with no minimum spend requirements

Yes, Venn holds eligible deposits at our Partner Institution in our trust accounts, including deposits in foreign currencies. CDIC protects eligible deposits up to CA$100,000 per deposit category per CDIC member institution.

No, we don’t have any hidden fees! All charges, including currency conversion and premium plans, are clear and transparent. You can even issue unlimited corporate cards to your team and sign up with a free plan in minutes! Learn more about our transparent Pricing.

Nope! Other companies and traditional bank accounts have high minimum balance requirements. This makes accounts inaccessible for small businesses or individuals. Venn does not require a minimum balance. Your CAD and USD funds will also earn 2% interest regardless of the balance.

Our process is quick — Customers typically get set up in 5 minutes or less! Create a free account and start saving with no monthly fees, cashback on card spend, and the best FX rates around.

Of course! Our friendly Support specialists are available via Chat or Email 24 hours a day, 7 days a week, 365 days a year. All tickets are monitored and responded to within 24 hours, with an average response time of 30 minutes.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 5,000+ businesses banking with Venn today

Streamline your business banking and save on your spend and transfers today

No personal credit check or guarantee.